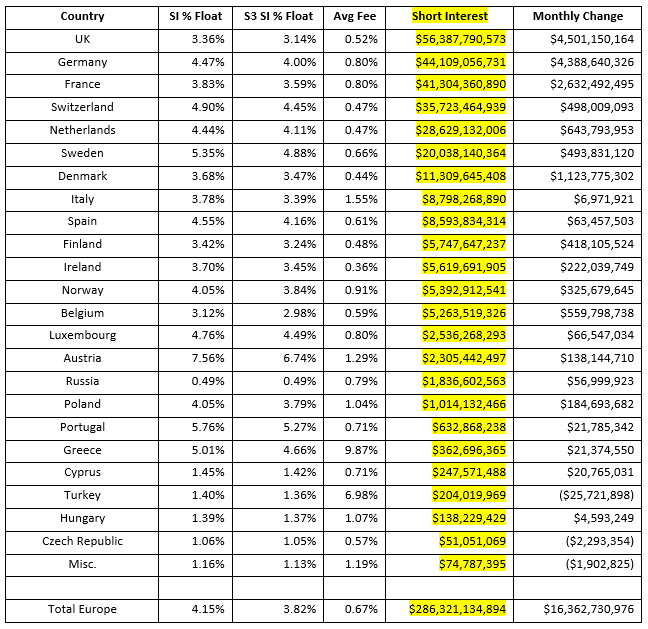

We follow over 5,200 equities, ADRs and GDRs with short interest in Europe in our Blacklight SaaS platform and Black App with $286 billion of total short interest. Average Short Interest % of Float is 4.15% and S3 SI % Float (which includes synthetic longs created by every short sale in the Float number) is 3.82%. The average stock borrow fee is 0.67%. As a comparison, U.S. equites have an average SI % Float of 5.30%, S3 SI % Float of 4.77% and average stock borrow fee of 0.53%.

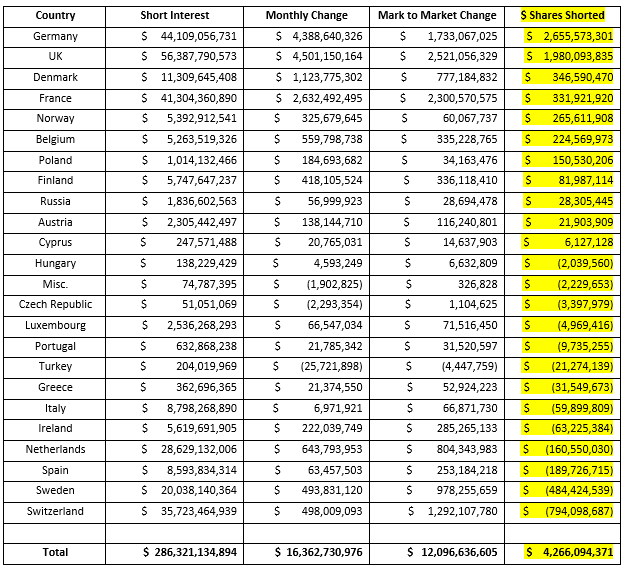

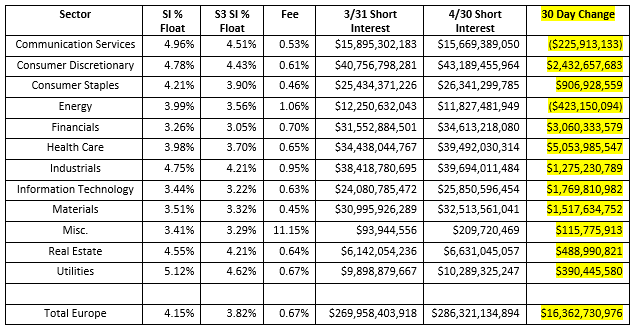

Overall European short exposure increased from $269.96 billion to $286.32 billion, an increase of +$16.36 billion or +6.1%, over the last 30 days. Change in short interest is comprised of mark-to-market price changes of existing shorts and short selling and covering. Over the last 30 days we saw a +$12.1 billion increase in the market-to-market value of existing short positions and an additional +$4.3 billion of net short selling.

When looking at short exposure by country, every European country, besides Turkey and the Czech Republic and some of the lesser shorted countries, saw an increase in net short interest regardless of short selling and covering activity over the last 30 days.

While changes in short interest reflects the increases and decreases in risk for an investor, their short selling activity actually effects a security’s price. Heavy short selling can help drive security prices down and short covering can help increase a security’s price. We saw $4.27 billion of net short selling in Europe over the last 30 days which had a negative impact on stock prices in some European countries. Short selling activity was not equal in every European country, with over $100 million of net short covering in Switzerland, the Netherlands, Sweden, and Spain while over $100 million of net short selling in the U.K., Germany, France, Denmark, Norway, Belgium, and Poland.

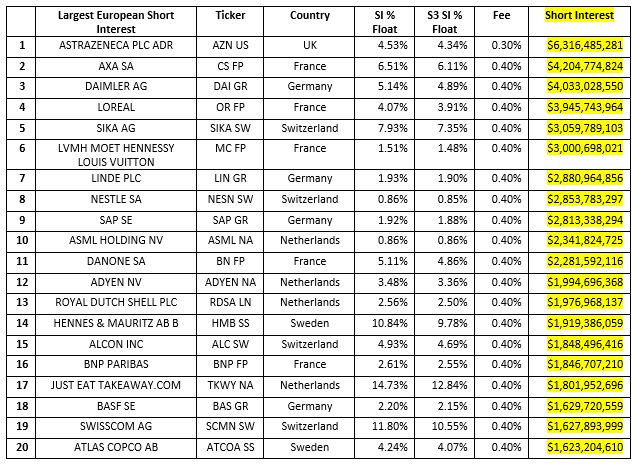

The largest individual European short positions are:

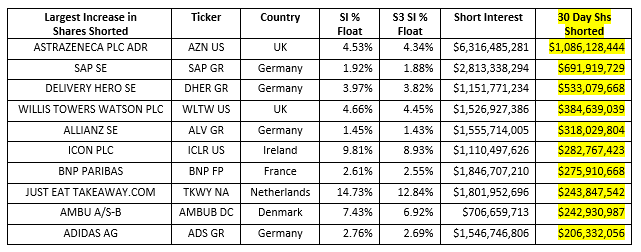

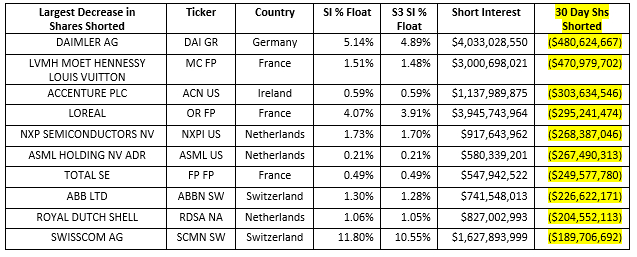

The largest increases and decreases in European shares shorted over the last 30 days are:

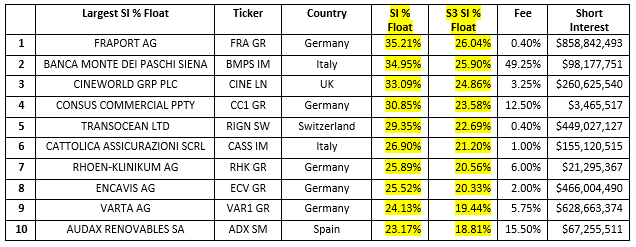

The largest European Short Interest as a % of Float with over $50 million of short interest are:

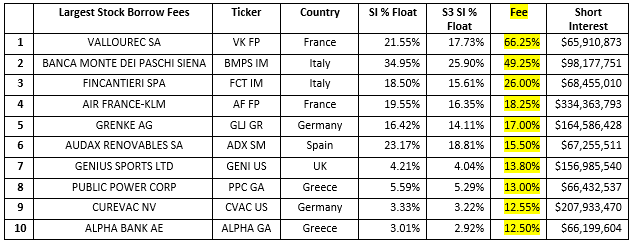

The largest European Stock Borrow Fees with over $50 million of short interest are:

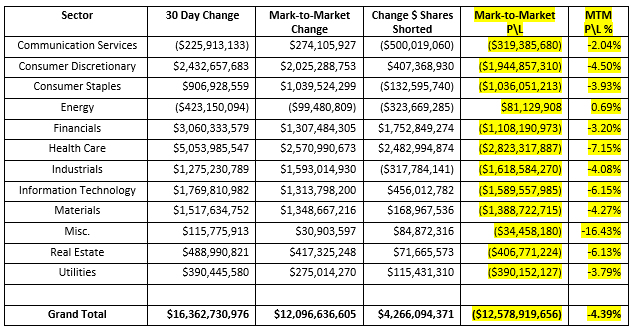

Most of the European sectors, besides the Energy and Communication Services sectors, had increases in net short interest over the last 30 days. The largest increases in short interest were in the Health Care Sector +$5.1 billion (AstraZeneca PLC, AZN US, +$1.4 billion and Ambu A/S, AMBUB DC, +$320 million); Financials Sector +$3.1 billion (Willis Towers Watson PLC, WLTW US, +$517 million and AXA SA, CS FP) +$398 million) and the Consumer Discretionary Sector (Delivery Hero, DHER GR, +$646 million and Just Eat Takeaway.com NV, TKWY NA, +$411 million).

With the European markets rising over the 30 days, short sellers were down -$12.58 billion in net-of-financing mark-to-market losses, -4.39%. Only the Energy Sector short sellers were slightly profitable with a +0.69% return.

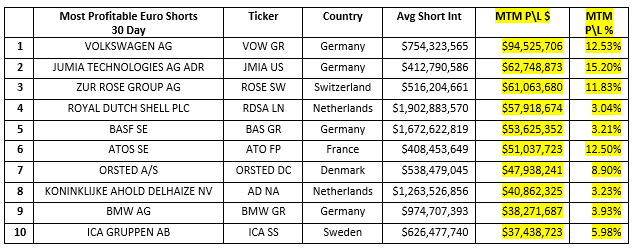

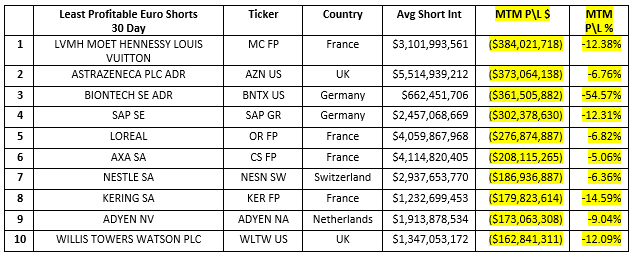

On a security basis, the most and least profitable European shorts over the last 30 days were:

Our multi-factor Crowded Score considers the overall size of the short, stock borrow liquidity\costs and trading liquidity in order to determine which stocks look crowded on the short side. The following are the most Crowded European shorts using our metric (out of 10).

Not every Crowded short is Squeezable as investors are not quick to exit winning strategies. Our Crowded scores coupled with mark-to-market losses give us an idea of which stocks have a higher potential for a Short Squeeze. A few European stocks with higher chances of a short squeeze (out of 10) if their stock prices continue to climb are:

Looking at short selling trends over time provides insight into overall market sentiment as well as the strength of bearish conviction in individual equities. Our Blacklight SaaS platform and Black APP provides an up to date view of short selling and short covering on an equity, sector, index, or country-wide basis allowing investors\traders to better manage their existing long and short positions.

Research Note written by Ihor Dusaniwsky, Managing Director of Predictive Analytics, S3 Partners, LLC

For deeper insight into short side data and analysis contact me at Ihor.Dusaniwsky@S3Partners.com

Click for 10 Day Complimentary Access to Bloomberg/S3 Black App Pro

The information herein (some of which has been obtained from third party sources without verification) is believed by S3 Partners, LLC (“S3 Partners”) to be reliable and accurate. Neither S3 Partners nor any of its affiliates makes any representation as to the accuracy or completeness of the information herein or accepts liability arising from its use. Prior to making any decisions based on the information herein, you should determine, without reliance upon S3 Partners, the economic risks, and merits, as well as the legal, tax, accounting, and investment consequences, of such decisions.