Short interest in the domestic market decreased by -$23.9 billion, or -2.23%, to $1.05 trillion in the fourth quarter of 2021. The decrease in shares shorted was a reaction to an up-trending market in the fourth quarter (S&P 500 up +10.65%, Nasdaq up +8.28% and Russell 3000 up +8.92%). Most of this decrease, -$38.2 billion, came from short covering, which was offset by +$14.2 billion of mark-to-market increases in short interest. Short sellers decreased their bets as mark-to-market losses negatively affected their bottom lines in the final leg to year-end.

S3 Partners

-

FAANG stocks were up an average of +27.3% in 2021 but Amazon.com Inc (AMZN) underperformed the group significantly with only a +2.4% return. Shorting FAANG stocks was an unprofitable strategy in 2021, contributing $14.6 billion of mark-to-market losses to short seller’s bottom lines. Surprisingly, only AMZN is seeing outsized recent short covering in the group, with almost $4 billion of buy-to-covers over the last thirty days, a -26.5% decrease in shares shorted. Much like Punxsutawney Phil not seeing his shadow and predicting an early spring, AMZN short covering may be a harbinger of a much greener price performance in 2022.

read more -

McDonald’s Corp’s (MCD) slogan in 2008 was “What we’re made of” and according to Piper Sandler part of that will be plant-based in 2022. Pipe Sandler announced that McDonald’s will be launching the Beyond Meat (BYND) McPlant Burger nationwide in the 1st quarter 2022.

read more -

CNBC recently created a new index which tracks “stocks integral to lives and careers of millennials and those from Generation Z”. According to CNBC the index is up over 40% in 2021, but down over the last month. Going long meme and Reddit names has been the new trend in 2021, will buying and shorting the CNBC Next Gen Index be the new retail vs institutional battle ground?

read more -

After an early year rally in the Homebuilders sector, we had seen stock prices trending downward since the middle of May but now rebounding since the middle of October. With unemployment falling and wages rising, building costs soaring, mortgage rates falling earlier in the year but rising now and housing supply still tight the Homebuilding sector has been a rollercoaster of profits and losses for both the long and short side of the market.

read more -

Avis Budget Group Inc (CAR) is up over +90% in mid-day trading after being up +218% earlier in the morning. CAR did report a blowout third quarter with EBITDA topping $1.0 billion and surpassing estimates by over 40% and received board approval for an additional $1.1 billion in share repurchases but today’s stock move dwarfs yesterday’s +6.5% move in after-hours trading. CAR short interest is $2.37 billion, 2.56 million shares shorted, 21.10% Short Interest % Float, 17.42% S3 Short Interest % Float (which includes the long shares created by short selling in the float denominator), and a 0.30% stock borrow fee.

read more -

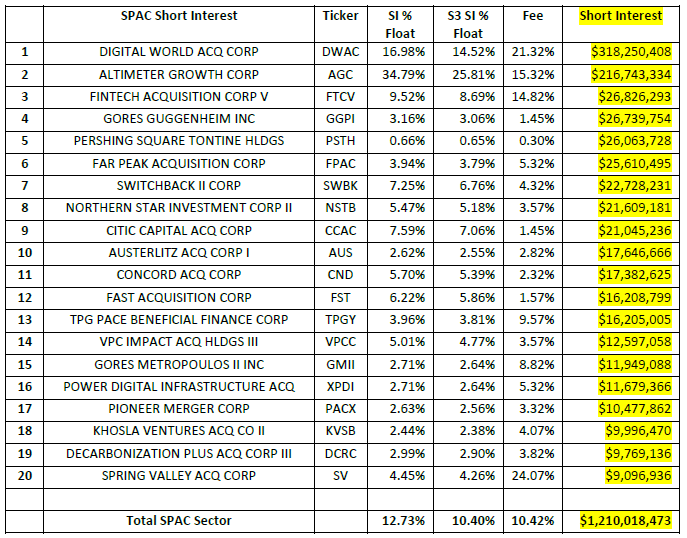

We follow 1,468 SPAC securities (equities and warrants) that have short interest on our Blacklight SaaS Platform and Black App. Total short interest in the SPAC sector had been declining over the past few months as large SPAC short positions such as Churchill Capital Corp IV (CCIV), Social Capital Hedosophia Holdings V (IPOE) and Switchback Energy Acquisition Corp (SBE) were de-SPACed, but we have seen a recent rise in SPAC short interest. Total SPAC short interest is now $1.21 billion, an increase of +$443 million over the last thirty days. Most of this increase can be attributed to new short selling activity in the Digital World Acquisition Corp (DWAC) SPAC.

read more The SPAC sector’s average Short Interest % Float is 12.76% while the average S3 SI % Float of 10.40% (which includes the synthetic longs created by every short sale in the trade float denominator) with an average stock borrow fee of 10.42%. In contrast, stocks in the U.S. have a total short interest of $1.18 trillion, SI % Float of 5.17%, S3 SI % Float of 4.68% and an average stock borrow fee of 0.71%.

The SPAC sector’s average Short Interest % Float is 12.76% while the average S3 SI % Float of 10.40% (which includes the synthetic longs created by every short sale in the trade float denominator) with an average stock borrow fee of 10.42%. In contrast, stocks in the U.S. have a total short interest of $1.18 trillion, SI % Float of 5.17%, S3 SI % Float of 4.68% and an average stock borrow fee of 0.71%. -

Paraphrasing Simon & Garfunkel, “Hello Tesla, my dear friend”, Tesla Inc.’s (TSLA) short interest has once again become a hot topic of conversation as its stock price surged over 30% in October and the stock joined the $1 trillion market cap club. As a result, short sellers are once again deep in the red and the anticipation of a significant short squeeze grows.

read more -

While Jeff Bezos and Blue Origin are celebrating for boldly sending a 90-year-old where no 90-year-old has ever gone before as Captain Kirk\William Shatner reached outer space this week, Sir Richard Branson and Virgin Galactic may be looking to beam Scotty up to address the flight capability of its VMS Eve and VSS Unity space vehicles which have delayed their near-term space flights. This delay in test flights and future commercial flights saw Virgin Galactic Holdings Inc (SPCE) fall over 20% in premarket trading and now down -13% in early morning trading.

read more -

We follow 1,429 SPAC securities (equities and warrants) that have short interest on our Blacklight SaaS Platform and Black App. Total short interest in the SPAC sector has been declining over the past few months as large SPAC short positions such as Churchill Capital Corp IV (CCIV), Social Capital Hedosophia Holdings V (IPOE) and Switchback Energy Acquisition Corp (SBE) were de-SPACed. Total SPAC short interest has fallen below the $1 billion dollar level in September\October for the first time since the beginning of the year and is now $934 million, down over $2.5 billion from highs of over $3.5 billion in May.

read more