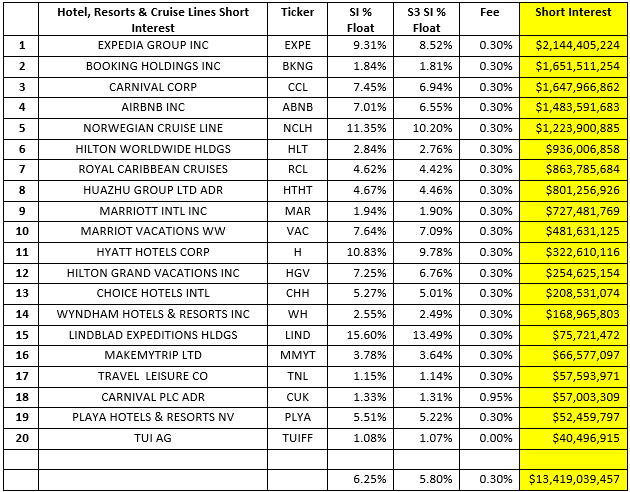

Airbnb Inc (ABNB) continues to be a significant short in its sector, ranking fourth in the Hotel, Resorts & Cruise Line Sector but recent short covering activity has reduced its total short interest by $1.3 billion. ABNB short interest is $1.48 billion, 9.69 million shares shorted, 7.01% Short Interest % Float, 6.55% S3 Short Interest % Float, 0.30% stock borrow fee.

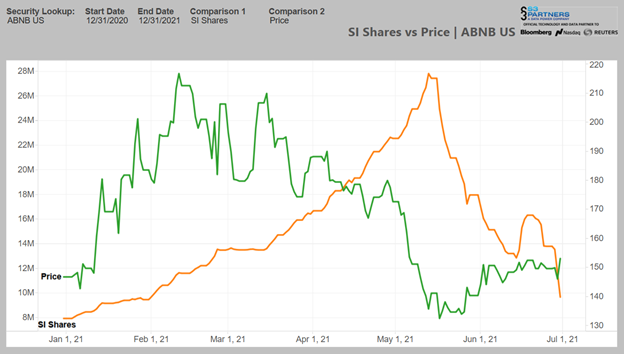

ABNB shares shorted topped out in mid-May with 27.8 million shares shorted, 19.9 million new shares were shorted, worth +3.04 billion, a +250% increase since the beginning of the year. But since hitting its peak in shares shorted, short sellers have been covering their exposure at an expedited pace. In just over six weeks short sellers bought-to-cover 18.1 million shares, worth $2.78 billion, a -65% decrease in total shares shorted.

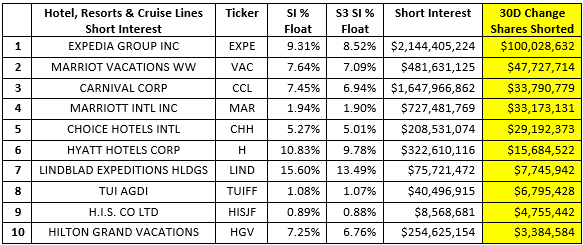

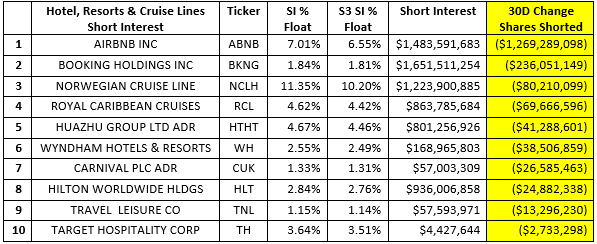

We saw net short covering in the Hotel, Resorts & Cruise Lines Sector with $1.53 billion of shorts being covered and ABNB making up 83% of the total. The only other +$100 million dollar moves in shares shorted were Bookings Holdings Inc (BKNG) $236 million in short covering and Expedia Group Inc (EXPE) with $100 million of new short selling. Of the three travel services stocks, shorts were covering in ABNB and BKNG while short selling EXPE.

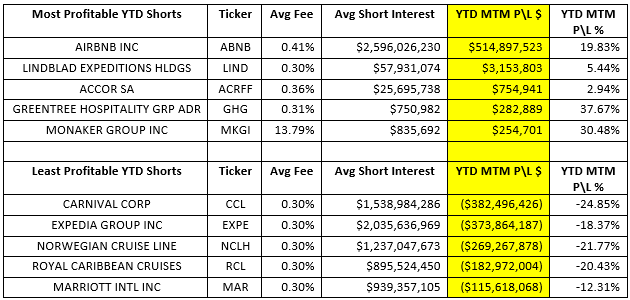

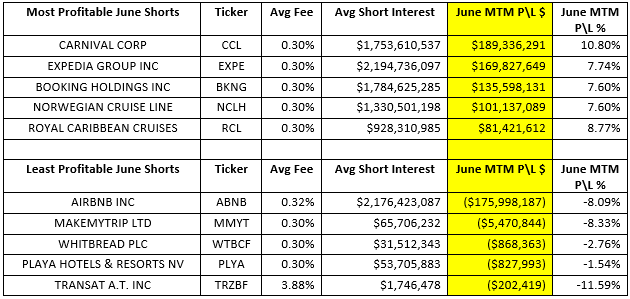

ABNB continues to be a profitable short on a yar-to-date basis, up +$515 million in year-to-date net-of-financing mark-to-market profits, for a +19.83% yearly return on outstanding short balances. But over the last thirty days ABNB shorts have given back -$176 million of their profits, down -8.09%, as the stock’s price rallied. With so much ABNB active short covering going on it seems that the shorts are trying to close out their positions before their hard earned profits disappear. Mark-to-market losses are usually the primary reason for a short squeeze (short covering) and ABNB is a clear cut example of a classic short squeeze.

With ABNB shorts exiting their positions in size and in haste, it looks like the stock is ready to break through its June $144-$153 trading range. Not only is there a lack of short selling activity helping to keep the stock price down, but short sellers are now buying stock alongside ABNB’s long shareholders and helping to drive the stock price up as post-pandemic travel buoys summer revenues.

Looking at short selling trends over time provides insight into overall market sentiment as well as the strength of bearish conviction in individual equities. Our Blacklight SaaS platform and Black APP provides an up to date view of short selling and short covering on an equity, sector, index, or country-wide basis allowing investors\traders to better manage their existing long and short positions.

Research Note written by Ihor Dusaniwsky, Managing Director of Predictive Analytics, S3 Partners, LLC

For deeper insight into short side data and analysis contact me at Ihor.Dusaniwsky@S3Partners.com

For short side data and access to our research reports go to https://shortsight.com/

Click for 10 Day Complimentary Access to Bloomberg/S3 Black App Pro

The information herein (some of which has been obtained from third party sources without verification) is believed by S3 Partners, LLC (“S3 Partners”) to be reliable and accurate. Neither S3 Partners nor any of its affiliates makes any representation as to the accuracy or completeness of the information herein or accepts liability arising from its use. Prior to making any decisions based on the information herein, you should determine, without reliance upon S3 Partners, the economic risks, and merits, as well as the legal, tax, accounting, and investment consequences, of such decisions.