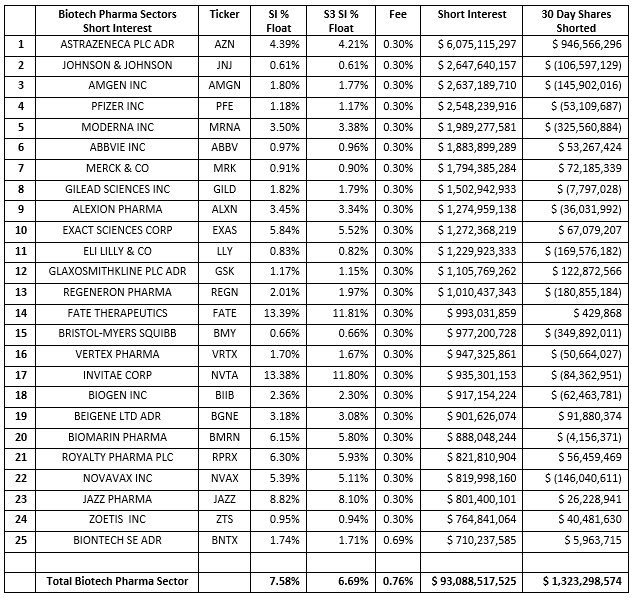

We have seen increased short selling in the Biotech and Pharmaceutical Sectors over the last month as the sectors were giving back some of their 1st quarter growth. Over the last 30 days the XBI Biotech ETF is down -8.55% and the XPH Pharma ETF is down -6.66%. In response to these declines Biotech-Pharma short sellers have sold short an additional $1.32 billion worth of stock over the last 30 days.

Short interest in the Biotech-Pharma Sectors has increased from $92.62 billion to $93.09 billion over the last 30 days. This +$473 million increase consisted of a -$850 million drop in market value due to stock price declines offset by +$1.32 billion of new short selling. As the value of their short Biotech-Pharma holdings were decreasing, short sellers were generating mark-to-market profits and continuing to sell into the price weakness and increasing their short positions.

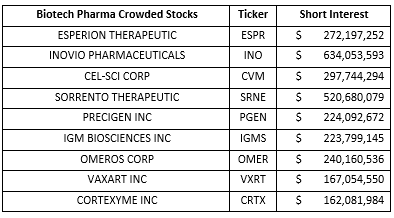

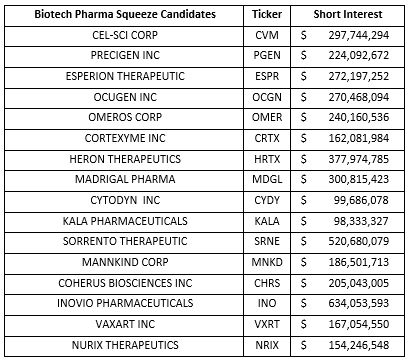

With short interest in the Biotech Pharma Sectors growing, increasing from $51.9 billion on January 2019, $76.2 billion on January 2020, $84.8 billion on January 2021 to $93.1 billion this week we have several names which have gotten crowded. Stocks which have more dollars at risk on the short side, have a large proportion of their tradable float shorted, tighter stock loan liquidity and\or tighter trading liquidity are considered Crowded:

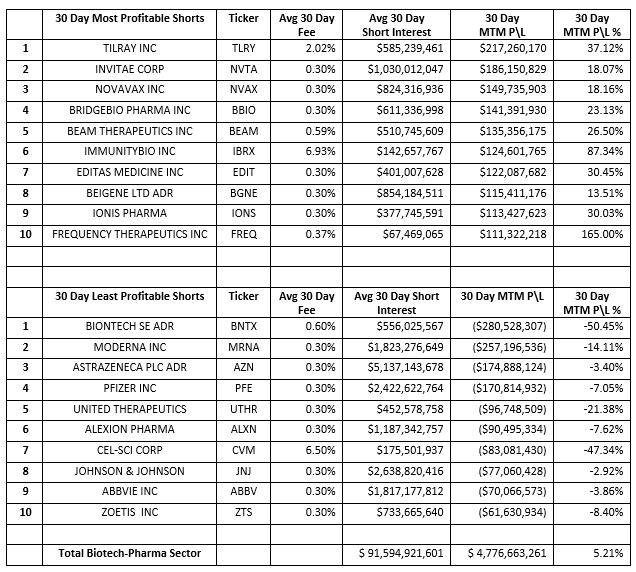

Biotech-Pharma short sellers were up +$4.78 billion, +5.21%, in net-of-financing mark-to-market profits over the last 30 days. The recent sector wide weakness made most Biotech-Pharma shorts profitable with only 22% of the Biotech-Pharma shorted securities producing red (unprofitable) numbers. Short sellers are still down -$2.31 billion in year-to-date losses, -2.50%.

Shorts are more likely to increase their positions in downward moving stocks and cut their positions in upward moving stocks. The recent profits on the short side have lessened the squeeze potential of many Biotech Pharma shorts. But there are still quite a few stocks that are both “crowded” and “squeezable” and may see short covering if their stock prices rise.

Looking at short selling trends over time provides insight into overall market sentiment as well as the strength of bearish conviction in individual equities. Our Blacklight SaaS platform and Black APP provides an up to date view of short selling and short covering on an equity, sector, index, or country-wide basis allowing investors\traders to better manage their existing long and short positions.

Research Note written by Ihor Dusaniwsky, Managing Director of Predictive Analytics, S3 Partners, LLC

For deeper insight into short side data and analysis contact me at Ihor.Dusaniwsky@S3Partners.com

Click for 10 Day Complimentary Access to Bloomberg/S3 Black App Pro

The information herein (some of which has been obtained from third party sources without verification) is believed by S3 Partners, LLC (“S3 Partners”) to be reliable and accurate. Neither S3 Partners nor any of its affiliates makes any representation as to the accuracy or completeness of the information herein or accepts liability arising from its use. Prior to making any decisions based on the information herein, you should determine, without reliance upon S3 Partners, the economic risks, and merits, as well as the legal, tax, accounting, and investment consequences, of such decisions.