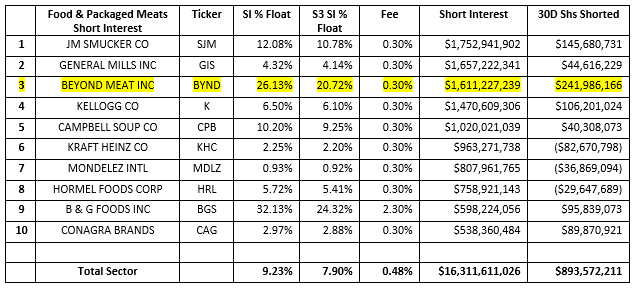

Beyond Meat Inc (BYND US) short interest is $1.61 billion, 14.55 million shares shorted, 26.13% Short Interest % Float, 20.72% S3 SI % Float (which includes the synthetic longs created by every short sale in the trade float denominator) and 0.30% (General Collateral) stock borrow fee. BYND is the third largest short in the Food & Packaged Meat Sector.

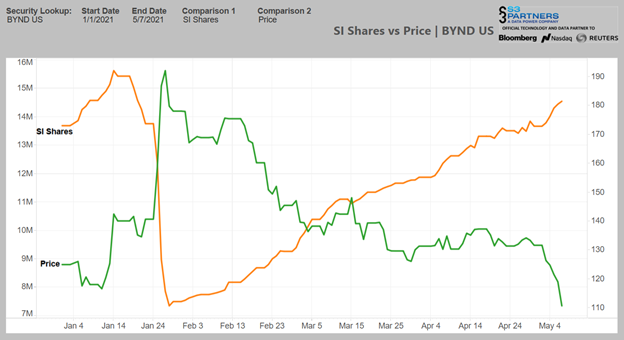

BYND’s stock price rose from $116.64 on January 11th to a year-to-date high of $192.08 on January 26th after it announced a joint venture with PepsiCo (PEP), which created a massive squeeze on the short side. The crush of short covering saw BYND shares shorted drop from 15.63 million shares to 7.35 million shares, a -53% decline worth over $1.5 billion. This short selling, coupled with strong long buying pressure was responsible for the +65% gain in its stock price.

But since January 28th short sellers have been steadily rebuilding their positions, total shares shorted are now at 14.55 million shares. BYND short sellers have been actively shorting into price weakness and the recent big drop in stock price has re-invigorated short selling even more. Over the last thirty days we have seen 2.19 million shares shorted, worth $242 million, a +18% increase in share shorted as its stock price fell -15%. BYND was the fourth most shorted stock in the U.S. market over the last thirty days behind only Skillz Inc (SKLZ) at $305 million, Bed Bath & Beyond (BBBY) at $275 million and AMC Entertainment at $2427 million of short selling.

BYND short sellers were down -$749 million in mark-to-market year-to-date losses after the stock hit its $192.08 high on Jan 27th. But since then, short sellers have recouped all of their losses and more. BYND shorts are now up +$122 million in year-to-date net of-financing mark-to-market profits, including +$51 million on today’s -3.17% price move.

While BYND is a relatively crowded short, with a 7.75 out of 10.00 score in our Crowded Score metric, its recent profitability has dramatically reduced its potential squeezability in the short term. BYND has a 4.75 out of 10.00 Squeeze Score as it would take a large and extended upwards price move to make short sellers unprofitable again and force them out of their positions.

If BYND continues its downward stock price trend we should see continued short selling and shares shorted threaten BYND’s 15.63 million historical high water mark of shares shorted that it hit on January 14th of this year. With increased competition from the likes of Impossible Foods and Tyson Foods Inc (TSN) the chances of another PepsiCo type +65% price move are slim. And even if BYND’s stock price does stabilize, shorts are probably not looking to rush for the exits with $122 million in mark-to-market profits as a cushion.

As long as BYND’s stock price continues its downward trend we should see additional short selling in the stock. With short sellers now profitable, BYND short interest could hit the $2 billion level by the end of summer as existing shorts build on their profitable positions and new shorts look to get into the stock. BYND should continue to be one of the more shorted stocks in the market.

Looking at short selling trends over time provides insight into overall market sentiment as well as the strength of bearish conviction in individual equities. Our Blacklight SaaS platform and Black APP provides an up to date view of short selling and short covering on an equity, sector, index, or country-wide basis allowing investors\traders to better manage their existing long and short positions.

Research Note written by Ihor Dusaniwsky, Managing Director of Predictive Analytics, S3 Partners, LLC

For deeper insight into short side data and analysis contact me at Ihor.Dusaniwsky@S3Partners.com

Click for 10 Day Complimentary Access to Bloomberg/S3 Black App Pro

The information herein (some of which has been obtained from third party sources without verification) is believed by S3 Partners, LLC (“S3 Partners”) to be reliable and accurate. Neither S3 Partners nor any of its affiliates makes any representation as to the accuracy or completeness of the information herein or accepts liability arising from its use. Prior to making any decisions based on the information herein, you should determine, without reliance upon S3 Partners, the economic risks, and merits, as well as the legal, tax, accounting, and investment consequences, of such decisions.