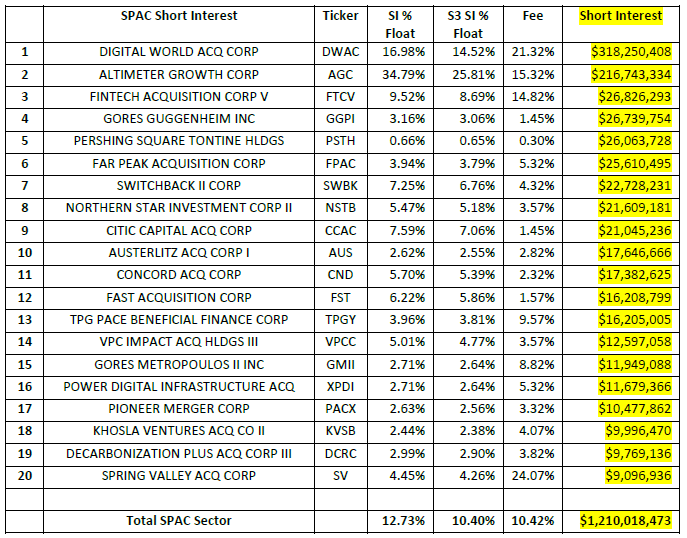

We follow 1,468 SPAC securities (equities and warrants) that have short interest on our Blacklight SaaS Platform and Black App. Total short interest in the SPAC sector had been declining over the past few months as large SPAC short positions such as Churchill Capital Corp IV (CCIV), Social Capital Hedosophia Holdings V (IPOE) and Switchback Energy Acquisition Corp (SBE) were de-SPACed, but we have seen a recent rise in SPAC short interest. Total SPAC short interest is now $1.21 billion, an increase of +$443 million over the last thirty days. Most of this increase can be attributed to new short selling activity in the Digital World Acquisition Corp (DWAC) SPAC.  The SPAC sector’s average Short Interest % Float is 12.76% while the average S3 SI % Float of 10.40% (which includes the synthetic longs created by every short sale in the trade float denominator) with an average stock borrow fee of 10.42%. In contrast, stocks in the U.S. have a total short interest of $1.18 trillion, SI % Float of 5.17%, S3 SI % Float of 4.68% and an average stock borrow fee of 0.71%.

The SPAC sector’s average Short Interest % Float is 12.76% while the average S3 SI % Float of 10.40% (which includes the synthetic longs created by every short sale in the trade float denominator) with an average stock borrow fee of 10.42%. In contrast, stocks in the U.S. have a total short interest of $1.18 trillion, SI % Float of 5.17%, S3 SI % Float of 4.68% and an average stock borrow fee of 0.71%.

SPACs

-

-

We follow 1,429 SPAC securities (equities and warrants) that have short interest on our Blacklight SaaS Platform and Black App. Total short interest in the SPAC sector has been declining over the past few months as large SPAC short positions such as Churchill Capital Corp IV (CCIV), Social Capital Hedosophia Holdings V (IPOE) and Switchback Energy Acquisition Corp (SBE) were de-SPACed. Total SPAC short interest has fallen below the $1 billion dollar level in September\October for the first time since the beginning of the year and is now $934 million, down over $2.5 billion from highs of over $3.5 billion in May.

read more