Electric Vehicle Manufacturer short sellers are up over $1 billion in mark-to-market profits in mid-day trading may be a bit of a hyperbole as Tesla Inc (TSLA) shorts make up over $900 million of those profits but the reality is that shorting EV stocks in 2021 has been a profitable trade for all but one of the stocks in the sector, Nikola Corp (NKLA).

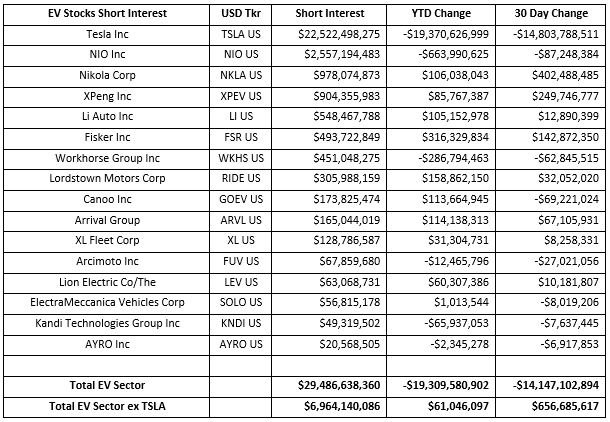

Short selling in the sector has been very active this year, except for Tesla which has been in the throes in a yearlong plus short squeeze. Even with continued short covering Tesla continues to be the largest short in the EV sector, 76% of the total short interest in the sector, as well as the largest worldwide short. Total short interest in the sector is $29.5 billion, down from $48.8 billion on January 1st. But if we remove the elephant in the room, Tesla, short interest is $7.0 billion, up $61 million for the year.

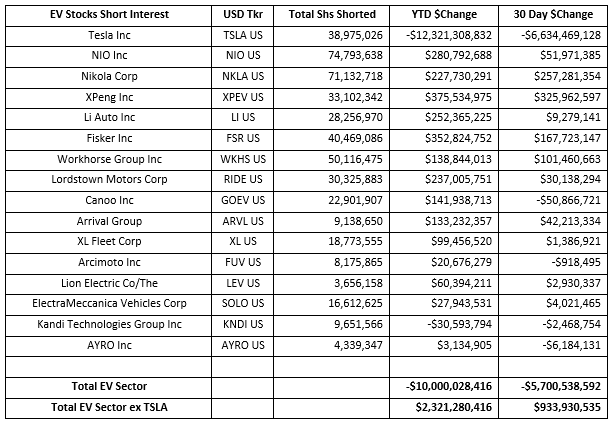

Change in short interest is made up of the change in market value of the underlying stocks as well as short selling and short covering activity in these stocks. TSLA had the largest decrease in short interest and its -$19.4 billion decrease was made up of -$12.3 billion of short covering and a -$7.1 billion decrease in mark-to-market price changes. The remaining 15 stocks in the sector also had a large mark-to-market price change, -$2.3 billion, but offset this drop in market value with +$2.3 billion of additional short selling, While TSLA shorts were reducing their overall short exposure as its stock price fell, short sellers in the other shorts in the sector were topping off their tanks and shorting into the price weakness.

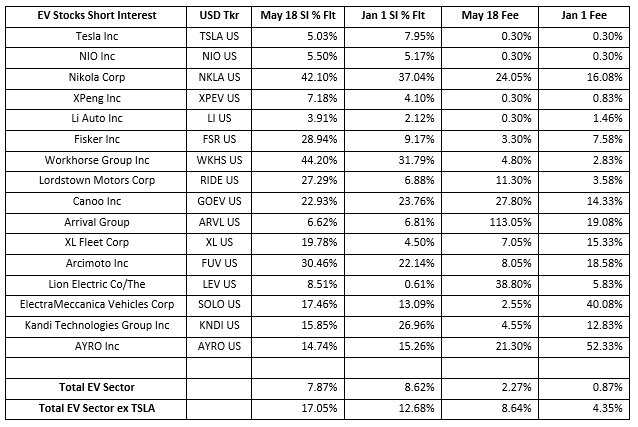

While Short Interest as a % of Float decreased for TSLA as it bought back 20.5 million shares, worth $12.32 billion, this year. But with additional short selling in the rest of the EV manufacturers, their SI % Float increased from 12.68% to 17.05%. This increase in shares shorted of these stocks was the main contributor in stock borrow fees nearly doubling from an average of 4.35% fee to 8.64% fee.

EV shorts were up just over $1 billion in mid-day mark-to-market profits today with TSLA shorts the big winners as Crypto weakness hit the auto manufacturer’s stock price. EV shorts are up +$7.83 billion for the year, with +$6.74 billion in mark-to-market profits occurring in the last thirty days. All the EV stocks in our portfolio were profitable year-to-date shorts except for Nikola Corp (NKLA).

In summary, we are seeing active short selling in EV stocks, except for TSLA, and short side profitability in EV stocks, except for NKLA. Increased competition in the EV (electric vehicle) space is coming from the traditional ICE (internal combustion engine) manufacturers as more of their planned EV fleets hit the showrooms. We should see further short selling in these EV based stocks with every Ford F-150 Lightning, VW ID.4 SUV, Audi Q4 e-tron, GMC Hummer and Mercedes-Benz EQS that leaves the production line. Increased competition in the form of new models hitting the show rooms will dilute market share across the EV platform – which should lead to more short selling in some of these EV stocks.

Looking at short selling trends over time provides insight into overall market sentiment as well as the strength of bearish conviction in individual equities. Our Blacklight SaaS platform and Black APP provides an up to date view of short selling and short covering on an equity, sector, index, or country-wide basis allowing investors\traders to better manage their existing long and short positions.

Research Note written by Ihor Dusaniwsky, Managing Director of Predictive Analytics, S3 Partners, LLC

For deeper insight into short side data and analysis contact me at Ihor.Dusaniwsky@S3Partners.com

Click for 10 Day Complimentary Access to Bloomberg/S3 Black App Pro

The information herein (some of which has been obtained from third party sources without verification) is believed by S3 Partners, LLC (“S3 Partners”) to be reliable and accurate. Neither S3 Partners nor any of its affiliates makes any representation as to the accuracy or completeness of the information herein or accepts liability arising from its use. Prior to making any decisions based on the information herein, you should determine, without reliance upon S3 Partners, the economic risks, and merits, as well as the legal, tax, accounting, and investment consequences, of such decisions.