While Jeff Bezos and Blue Origin are celebrating for boldly sending a 90-year-old where no 90-year-old has ever gone before as Captain Kirk\William Shatner reached outer space this week, Sir Richard Branson and Virgin Galactic may be looking to beam Scotty up to address the flight capability of its VMS Eve and VSS Unity space vehicles which have delayed their near-term space flights. This delay in test flights and future commercial flights saw Virgin Galactic Holdings Inc (SPCE) fall over 20% in premarket trading and now down -13% in early morning trading.

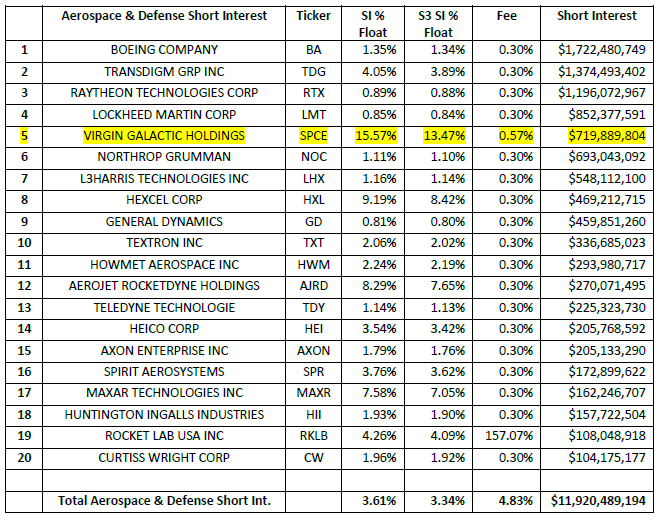

SPCE short interest is $720 million, 29.92 million shares shorted, 15.57% Short Interest % Float, 13.47% S3 SI % Float (which includes the synthetic longs created by every short sale in the trade float denominator), 0.57% stock borrow fee. SPCE is the fifth largest short in the Aerospace and Defense Sector.

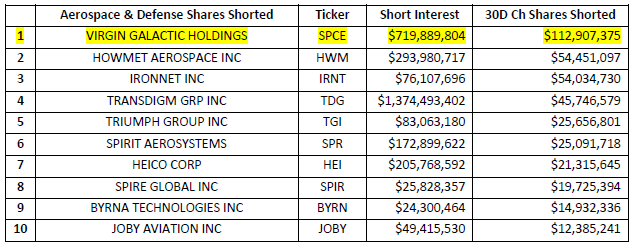

SPCE short sellers have been building their positions recently with its stock having the largest increase in shares shorted over the last thirty days. Aerospace & Defense stocks with the largest increase in short selling over the last thirty days are:

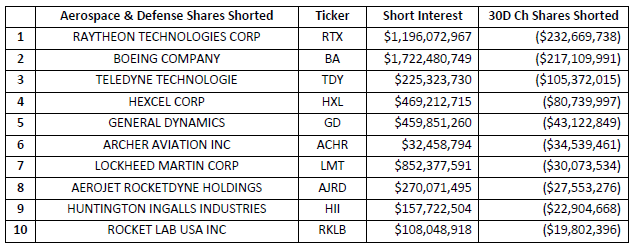

Aerospace & Defense stocks with the largest increase in short covering over the last thirty days are:

Aerospace & Defense stocks with the largest increase in short covering over the last thirty days are:

Virgin Galactic short sellers are up +$93.7 million in mark-to-market profits with its stock price down -13% in early morning trading. SPCE’s more than three-month price weakness has reversed a large portion of short seller’s early year losses. Shorts are up +$129 million in October, +18.3% and up +$987 million, +115.9%, since its last high of $55.91 on June 25th. Shorts are now “only” down -$503 million in year-to-date mark-to-market losses, down -56.7% for the year.

Today’s news and subsequent price move will probably entice more short sellers into the stock but there is still a long way to go before we near the 46.2 million shares shorted we saw in late May (historical high shares shorted was 47.9 million shares on 11/13/20). We’ve seen increased short selling since the beginning of September and the trend should continue.

Looking at short selling trends over time provides insight into overall market sentiment as well as the strength of bearish conviction in individual equities. Our Blacklight SaaS platform and Black APP provides an up-to-date view of short selling and short covering on an equity, sector, index, or country-wide basis allowing investors\traders to better manage their existing long and short positions.

Looking at short selling trends over time provides insight into overall market sentiment as well as the strength of bearish conviction in individual equities. Our Blacklight SaaS platform and Black APP provides an up-to-date view of short selling and short covering on an equity, sector, index, or country-wide basis allowing investors\traders to better manage their existing long and short positions.

Research Note written by Ihor Dusaniwsky, Managing Director of Predictive Analytics, S3 Partners, LLC

For deeper insight into short side data and analysis contact me at Ihor.Dusaniwsky@S3Partners.com

For short side data and access to our research reports go to https://research.s3partners.com/.