Paraphrasing Simon & Garfunkel, “Hello Tesla, my dear friend”, Tesla Inc.’s (TSLA) short interest has once again become a hot topic of conversation as its stock price surged over 30% in October and the stock joined the $1 trillion market cap club. As a result, short sellers are once again deep in the red and the anticipation of a significant short squeeze grows.

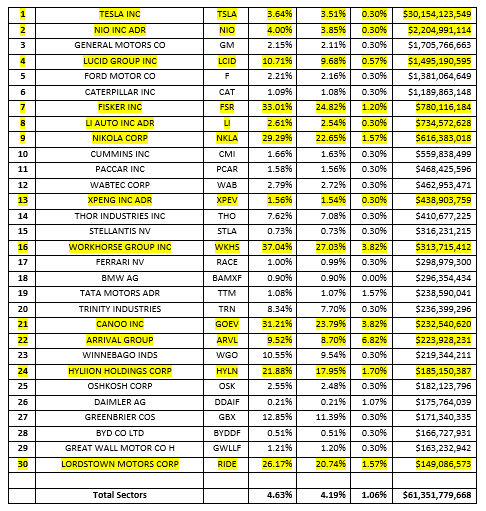

As of October 26th, TSLA short interest was $30.15 billion, 29.61 million shares shorted, 3.64% Short Interest % Float, 3.51% S3 SI % Float (which includes the synthetic longs created by every short sale in the trade float denominator), 0.30% stock borrow fee.

Tesla continues to be the largest equity\ADR short in the U.S. market even after being squeezed for most of 2021 due to accumulated net-of-financing mark-to-market losses. The O.G. social media short, Tesla, is jointed in the top thirty with all of the FAANG’s and social media’s recent B.F.F. AMC Entertainment (AMC).

All data as of October 26, 2021:

And of course, Tesla is the largest short in the Auto Manufacturing and Construction Machinery & Heavy Truck Sectors. There are a total of twelve electric vehicle stocks in the top thirty most shorted stocks in the sectors and they make up 59% of all short selling in the sectors.

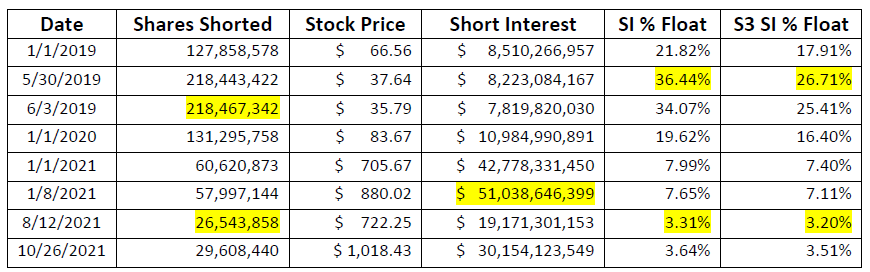

Tesla short sellers have been in a multi-year squeeze with shares shorted declining in the second half of 2019, all of 2020 and most of 2021. Tesla’s shares SI % Float peaked in late May of 2019 with total shares shorted topping out a few days later in early June. With Tesla in a multi-year rally, short sellers were trimming their positions as mark-to-market losses mounted. Even as shorts bought-to-cover shares their dollar short interest continued to climb as Tesla’s stock price surged. Total $ short interest hit its high point of $51.0 billion in January of 2021.

Continued short selling in 2021 brought Tesla’s shares shorted and SI % Float to three-year lows in August of 2021. Over the last two months we have seen a resurgence of Tesla short selling, bringing Tesla shares shorted off its lows in both shares shorted and SI % Float.

Over the last thirty days we saw a +1.19 million increase in shares shorted, worth $1.22 billion. This was a +4.2% increase in shares shorted even as Tesla’s stock price rose +32%. Over the past seven days we saw +308 thousand shares of new short selling, worth $313 million, a +1% increase in shares shorted with Tesla’s stock price rising +18%. Tesla short sellers seem to be shorting into the rally expecting a pullback from an overbought or overheated market.

Over the last thirty days we saw a +1.19 million increase in shares shorted, worth $1.22 billion. This was a +4.2% increase in shares shorted even as Tesla’s stock price rose +32%. Over the past seven days we saw +308 thousand shares of new short selling, worth $313 million, a +1% increase in shares shorted with Tesla’s stock price rising +18%. Tesla short sellers seem to be shorting into the rally expecting a pullback from an overbought or overheated market.

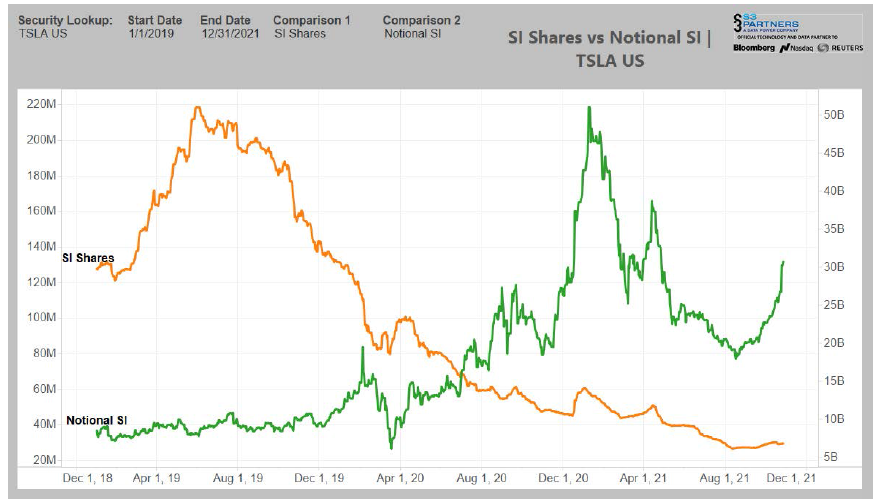

Shares shorted vs stock price:

Shares shorted vs $ Short interest (Notional SI):

Shares shorted vs $ Short interest (Notional SI):

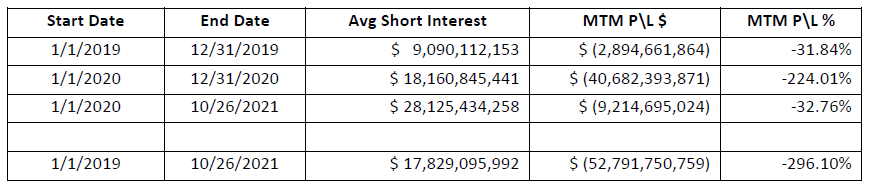

Tesla shorts are down -$52.8 billion in net-of-financing mark-to-market losses since 2019 with most of those losses occurring in 2020. Tesla short-side mark-to-market losses prior to October 2021 were “only” -$2.0 billion but Tesla’s recent price surge added -$7.2 billion in mark-to-market losses in less than a month.

Tesla shorts are down -$52.8 billion in net-of-financing mark-to-market losses since 2019 with most of those losses occurring in 2020. Tesla short-side mark-to-market losses prior to October 2021 were “only” -$2.0 billion but Tesla’s recent price surge added -$7.2 billion in mark-to-market losses in less than a month.

Looking at short selling trends over time provides insight into overall market sentiment as well as the strength of bearish conviction in individual equities. Our Blacklight SaaS platform and Black APP provides an up-to-date view of short selling and short covering on an equity, sector, index, or country-wide basis allowing investors\traders to better manage their existing long and short positions.

Research Note written by Ihor Dusaniwsky, Managing Director of Predictive Analytics, S3 Partners, LLC

For deeper insight into short side data and analysis contact me at Ihor.Dusaniwsky@S3Partners.com

For short side data and access to our research reports go to https://research.s3partners.com .

Click for 10 Day Complimentary Access to Bloomberg/S3 Black App Pro

The information herein (some of which has been obtained from third party sources without verification) is believed by S3 Partners, LLC (“S3 Partners”) to be reliable and accurate. Neither S3 Partners nor any of its affiliates makes any representation as to the accuracy or completeness of the information herein or accepts liability arising from its use. Prior to making any decisions based on the information herein, you should determine, without reliance upon S3 Partners, the economic risks, and merits, as well as the legal, tax, accounting, and investment consequences, of such decisions.