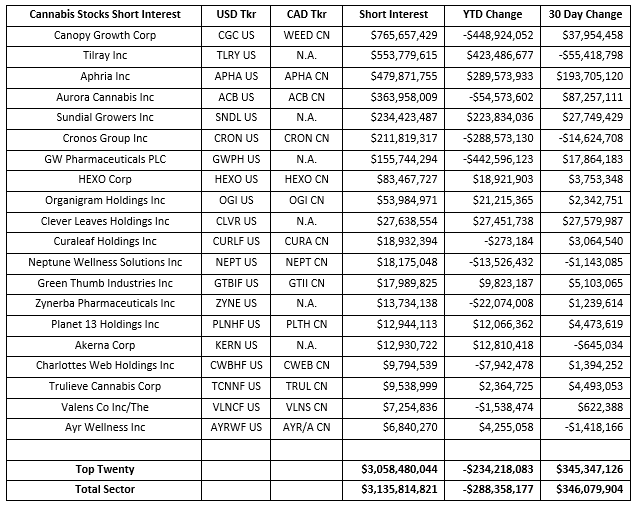

We are seeing active short selling in the Cannabis Sector over the last 30 days. Total short interest in the 119 U.S. and Canadian cannabis stocks in our portfolio is $3.14 billion with short selling highly concentrated in a handful of names. Short interest of the top twenty most shorted stocks in the sector is $3.06 billion, 98% of the total. While total short interest in our portfolio decreased by $288 million in 2021, short interest has increased by +$346 million over the last thirty days. Canopy Growth Corp (CGC US, WEED CN), Tilray Inc (TLRY US) and Aphria (APHA US, APHA CN) are the largest shorts in the sector.

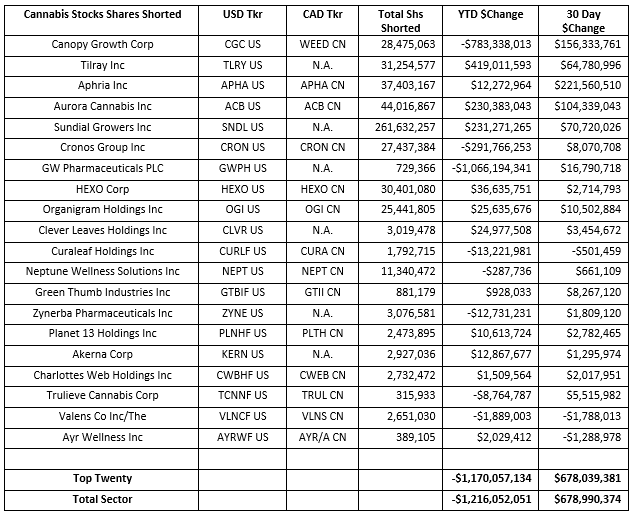

A change in short interest is made up of the mark-to-market price changes of shares shorted plus the change in overall shares shorted. The Cannabis Sector rally had stalled in mid-February with the ETFMG Alternative Harvest ETF (MJ US) up +131% by February 10th but down -36% since February 10th. Cannabis short sellers were getting squeezed out of their positions in the early part of the year but have resumed short selling recently, with $679 million of new short selling over the last thirty days. Even with this recent binge short selling, shorts have still covered $1.22 worth of shares for the year.

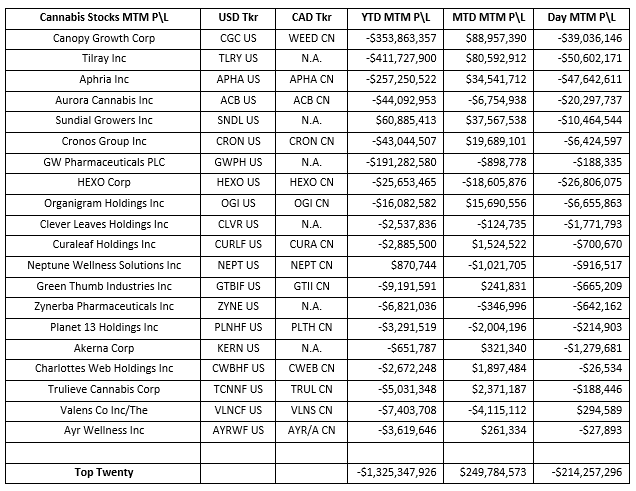

For the year, we saw increased short selling in Tilray (TLRY US) Sundial Growers (SNDL US) and Aurora Cannabis (ACB US, ACB CN) and increased short covering in GW Pharma (GWPH US), Canopy Growth (CGC US, WEED CN) and Cronos (CRON US, CRON CN). Over the last thirty days short sellers were active in all the shorts with over $25 million in short interest. The most shorted stocks being Aphria (APHA US, APHA CN), Canopy Growth (CGC US, WEED CN) and Aurora Cannabis (ACB US, ACB CN).

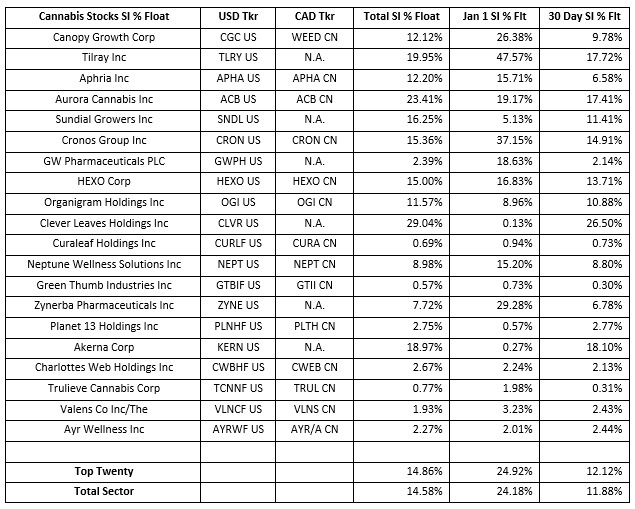

Total short interest % of float has declined from 24.2% to 14.6% in 2021 as the recent short selling has not come close to offsetting the amount of short covering we saw earlier in the year. But with the recent increase in short selling SI % Float is now trending upwards for nearly all the Cannabis stocks we are following.

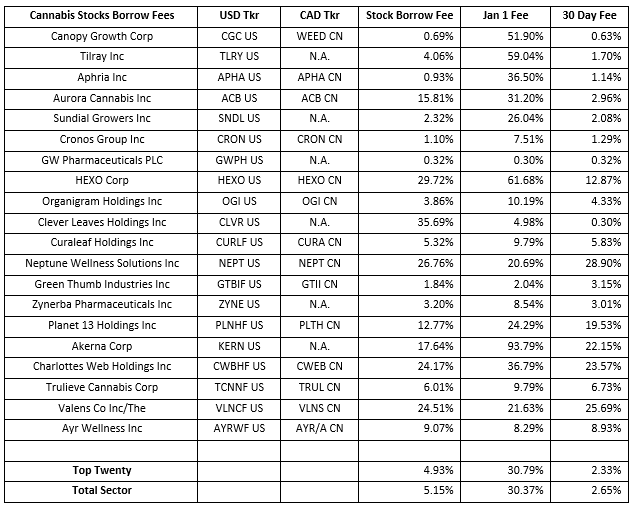

Along with SI % of Float, stock borrow fees are also trending higher. Stock borrow fees averaged over 30% fee at the beginning of January, but with more shares returning to lending pools due to widespread short covering the average stock borrow rate had dipped to the 2%-3% level in late March. With new short selling gobbling up available stock loans we are seeing this new stock borrow demand forcing stock borrow rates higher and the average stock borrow fee now topping the 5% fee level.

The top twenty cannabis shorts in the sector are down -$1.32 billion in net-of-financing mark-to-market losses in 2021. The early year rally had spurred short squeezes in most of the top twenty most shorted stocks in the sector, but recent price weakness has lessened the potential of a short squeeze in most of the names. Aurora Cannabis (ACB US, ACB CN) and Clever Leaves Holdings (CLVR US) are the only two stocks in the sector that continue to have relatively high potential for a short squeeze with Squeeze scores over 9 (out of 10).

Looking at short selling trends over time provides insight into overall market sentiment as well as the strength of bearish conviction in individual equities. Our Blacklight SaaS platform and Black APP provides an up to date view of short selling and short covering on an equity, sector, index, or country-wide basis allowing investors\traders to better manage their existing long and short positions.

Research Note written by Ihor Dusaniwsky, Managing Director of Predictive Analytics, S3 Partners, LLC

For deeper insight into short side data and analysis contact me at Ihor.Dusaniwsky@S3Partners.com

Click for 10 Day Complimentary Access to Bloomberg/S3 Black App Pro

The information herein (some of which has been obtained from third party sources without verification) is believed by S3 Partners, LLC (“S3 Partners”) to be reliable and accurate. Neither S3 Partners nor any of its affiliates makes any representation as to the accuracy or completeness of the information herein or accepts liability arising from its use. Prior to making any decisions based on the information herein, you should determine, without reliance upon S3 Partners, the economic risks, and merits, as well as the legal, tax, accounting, and investment consequences, of such decisions.