Short sellers of U.S. and Hong Kong listed H.K.\China securities have had a profitable run recently as the iShares MSCI China ETF (MCHI) was down -12% over the last month and the Invesco Golden Dragon China ETF (PGJ) which tracks the NASDAQ index holding U.S. listed Chinese companies was down -21%. Short sellers of HK\ Chinese securities have been actively shorting into this price weakness.

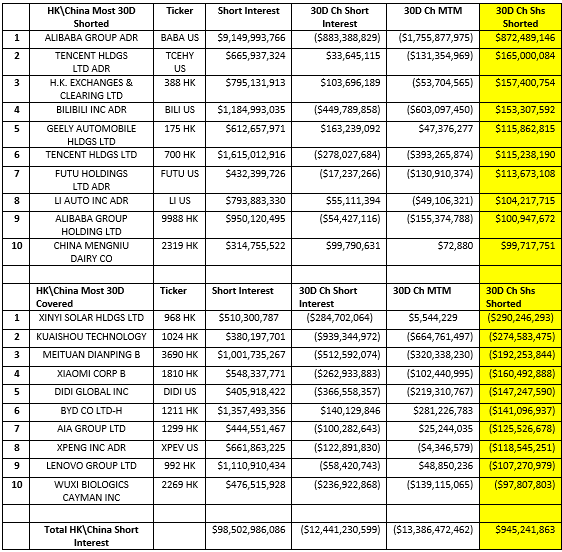

The largest H.K.\ China shorts are:

Overall, short interest in the region is down -$12.4 billion, -11%, from $11.1 billion to $98.5 billion with most of the drop resulting from a mark-to-market decrease in existing shorts of -$13.4 billion. Some of the drop in short interest was offset by $945 million of new short selling as shorts sold into price weakness.

The stocks with the largest increase and decrease in shares shorted are:

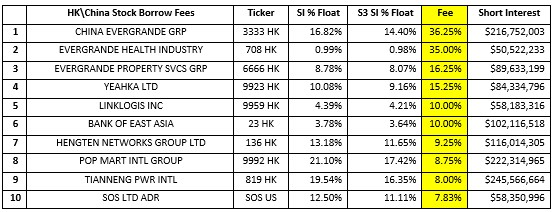

Shorts in the region with the highest SI % of Float with at least $50 million of short interest are:

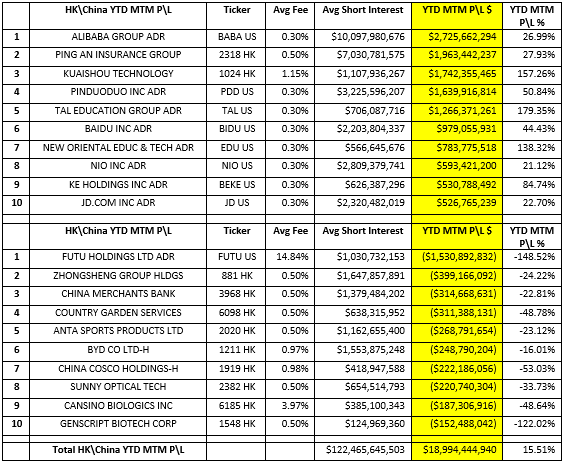

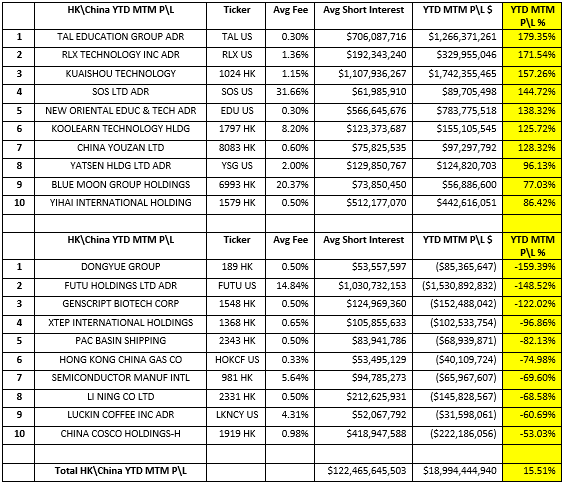

HK\China short sellers are up +$18.99 billion in year-to-date mark-to-market profits, up +15.51% for the year.

The most and least profitable year-to-date shorts on a $ basis are:

As expected, the largest winners and losers also were the stocks with some of the largest short interest numbers. Looking at YTD P\L by percentage will give us insight into which stocks had the best and worst returns in the region:

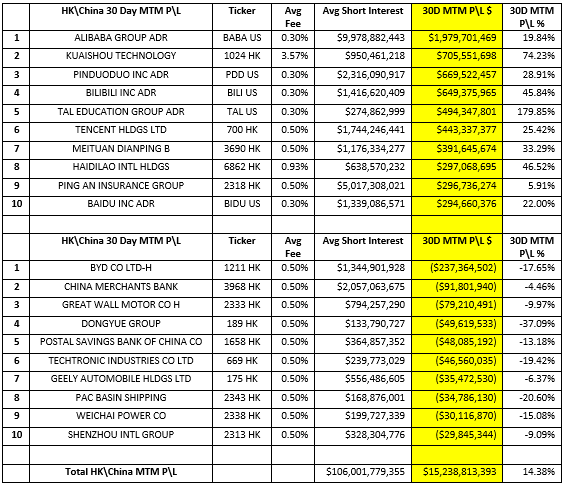

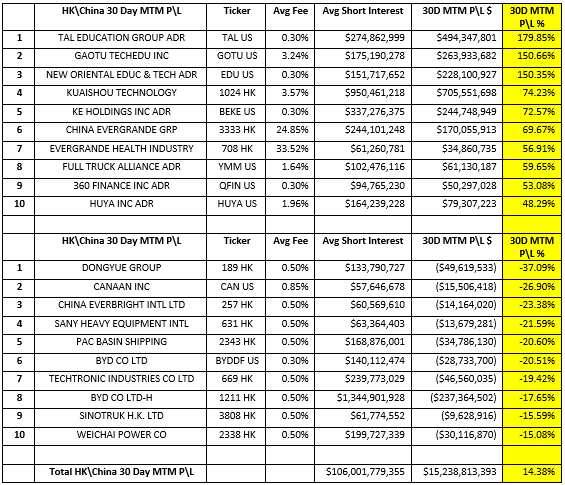

Most of the short side profits in the HK\China region occurred over the last thirty days. Mark-to-market profits over the last thirty days was +$15.24 billion, 80% of the total +$18.99 billion earned over the entire year.

The most and least profitable shorts over the past 30 days on a $ basis are:

And the most and least profitable shorts over the past 30 days on a % basis are:

The recent broad market weakness in the region has minimized the squeeze risk for most of the shorted stocks. A few shorted securities, which are crowded, did incur recent mark-to-market losses, and have higher squeeze risk potential. Stocks such as Lenovo Group Ltd (992 HK), China Hingqiao Group (1378 HK) and Vinda International Holdings (3331 HK) are a few of the stocks that have above average short squeeze risk.

Looking at short selling trends over time provides insight into overall market sentiment as well as the strength of bearish conviction in individual equities. Our Blacklight SaaS platform and Black APP provides an up-to-date view of short selling and short covering on an equity, sector, index, or country-wide basis allowing investors\traders to better manage their existing long and short positions.

Research Note written by Ihor Dusaniwsky, Managing Director of Predictive Analytics, S3 Partners, LLC

For deeper insight into short side data and analysis contact me at Ihor.Dusaniwsky@S3Partners.com

For short side data and access to our research reports go to https://shortsight.com/

Click for 10 Day Complimentary Access to Bloomberg/S3 Black App Pro

The information herein (some of which has been obtained from third party sources without verification) is believed by S3 Partners, LLC (“S3 Partners”) to be reliable and accurate. Neither S3 Partners nor any of its affiliates makes any representation as to the accuracy or completeness of the information herein or accepts liability arising from its use. Prior to making any decisions based on the information herein, you should determine, without reliance upon S3 Partners, the economic risks, and merits, as well as the legal, tax, accounting, and investment consequences, of such decisions.