Short sellers of U.S. listed H.K.\China securities have been riding a roller coaster of price moves recently. The Invesco Golden Dragon China ETF (PGJ) which tracks the NASDAQ index holding U.S. listed Chinese companies is down over -3% today on news of possible Chinese regulatory scrutiny into the “spiritual opium” of the gaming industry. This follows the cancelation of the Ant Group’s IPO last November, the cyber security regulator’s urging Didi Global (DIDI) to delay its IPO, increased regulatory oversight in the e-commerce and internet sectors and increased oversight in the afterschool education sector. The PGJ ETF was down nearly -29% from 6/30 to 7/27 as the Chinese government oversight in these sectors shook the Chinese market, but from 7/27 to 8/2 we saw a +11% rebound and shorts gave back some of their recently earned profits.

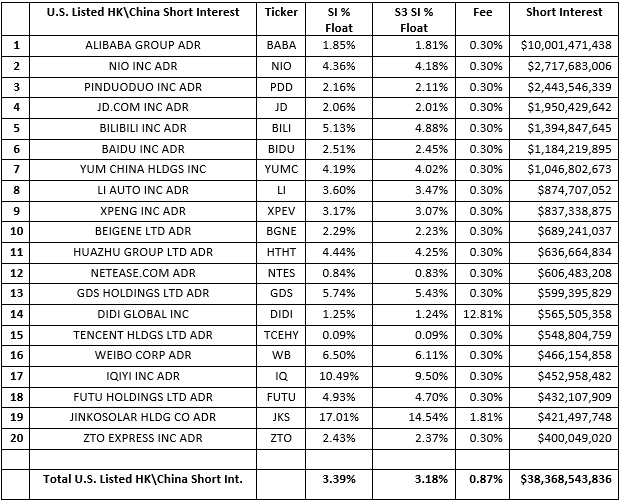

The largest U.S. listed H.K.\China shorts are:

Overall, U.S. listed H.K.\China equity short sellers are up +$7.76 billion in year-to-date net-of-financing mark-to-market profits, +15.3%, but most of those profits were generated in July. Shorts were up +$12.31 billion in mark-to-market profits from July 1st to 27th, +29.0%, but gave back 30% of their profits from July 28th to August 2nd with -$3.66 billion in mark-to-market losses, -9.7%.

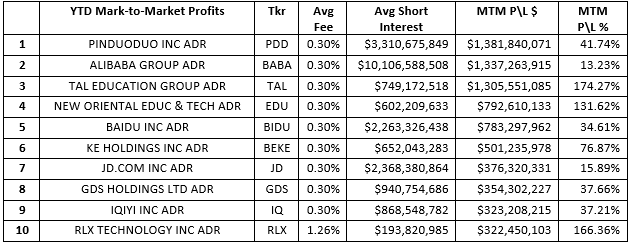

The most profitable shorts for the year are:

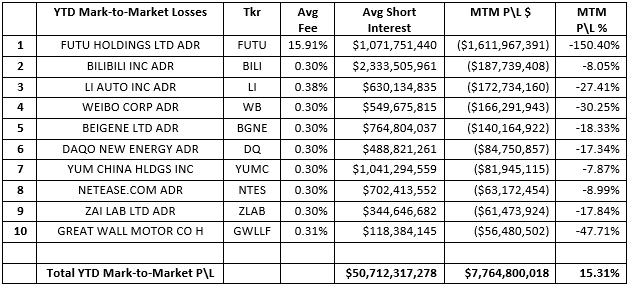

The least profitable shorts for the year are:

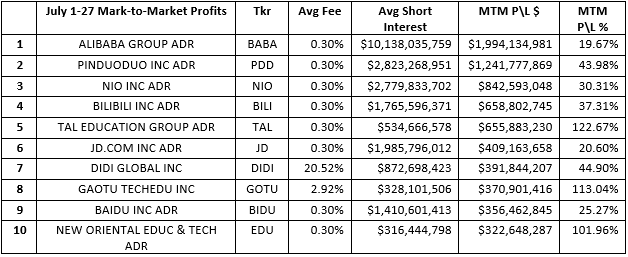

The July price weakness in these U.S. listed H.K.\China equities produced some big winners on the short side, with Alibaba (BABA) and Pinduoduo (PDD) leading the pack.

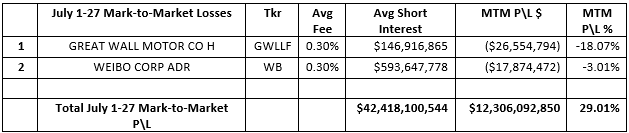

There were not many losing trades in the July, with only two stocks having more than -$10 million worth of mark-to-market losses:

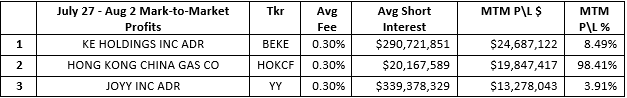

The recent rebound in U.S. listed H.K. China stocks was just as one-sided as its July price slump. There were only three shorted stocks with mark-to-market profits over +$10 million:

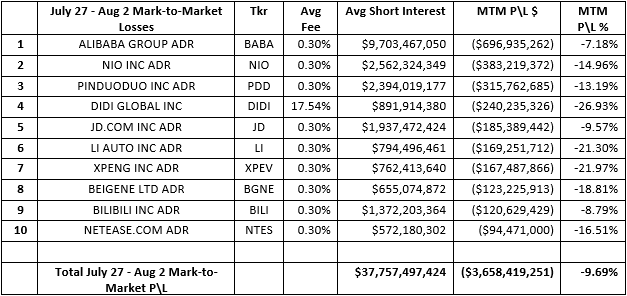

With most of the big short-side winners giving back a good portion of the mark-to-market profits they earned over the previous four weeks.

These large and volatile swings in stock prices and resulting mark-to-market profits and losses have and will affect short selling activity in these names. Surprisingly, we had not seen a significant increase in short selling in this sector recently, even though the profitability of these traded should have enticed short sellers to increase their positions or enter new ones. Over the last thirty days we saw a meager +$94 million of added short selling in these stocks.

While shorts were not looking to increase their exposure in these names as stock prices dropped, they may be quicker on the trigger if stock prices surge for an extended period of time in order to lock in recent mark-to-market profits. We’ve already seen nearly a third of their July profits get eaten up by the recent rebound rally, and if the rally continues, we should see a flurry of short covering as experienced short sellers look to be at the head of the line looking for exit points rather than waiting for the buy-to-covers of early short-covering to push stock prices even higher.

Looking at our Short Squeeze scores for this sub-sector of stocks we see a clear increase in overall squeezability. On July 1st, when many these stocks were in a relatively range bound trading period for several months, the average Squeeze Score for stocks over $25 million of short interest was 32.78.

On July 27th, after the PGJ ETF fell -29%, the average Short Squeeze score fell to 7.72. The chance of short squeezes in stocks which had earned significant recent mark-to-market profits was minimal.

But after several days of bullish price moves, the average Short Squeeze score on August 2nd has risen to 20.82. If stock prices in this sub-sector continue to strengthen this trend should hold and we should see short covering by short sellers looking to realize profits. Stocks that are tending towards squeezability at the moment are: Great Wall Motor Co (GWLLF), Agora Inc ADR (API), JinkSolar Holding Co ADR (JKS), Huya Inc ADR (HUYA), EHang Holdings ADR (EH) and DiDi Global (DIDI).

Price action in the near term will greatly affect the Squeeze Scores and squeezability of these U.S. listed H.K.\China securities. But if a rebound rally does occur, stocks with large short interest and large recent short-side market-to-market profits should have buy-to-covers helping to push stock prices even higher. An extended buy-side rebound rally in these securities will probably force some shorts out of their positions – the short covering squeeze and lack of new short selling pressure should reduce the friction of upward price moves.

Looking at short selling trends over time provides insight into overall market sentiment as well as the strength of bearish conviction in individual equities. Our Blacklight SaaS platform and Black APP provides an up-to-date view of short selling and short covering on an equity, sector, index, or country-wide basis allowing investors\traders to better manage their existing long and short positions.

Research Note written by Ihor Dusaniwsky, Managing Director of Predictive Analytics, S3 Partners, LLC

For deeper insight into short side data and analysis contact me at Ihor.Dusaniwsky@S3Partners.com

For short side data and access to our research reports go to https://shortsight.com/

Click for 10 Day Complimentary Access to Bloomberg/S3 Black App Pro

The information herein (some of which has been obtained from third party sources without verification) is believed by S3 Partners, LLC (“S3 Partners”) to be reliable and accurate. Neither S3 Partners nor any of its affiliates makes any representation as to the accuracy or completeness of the information herein or accepts liability arising from its use. Prior to making any decisions based on the information herein, you should determine, without reliance upon S3 Partners, the economic risks, and merits, as well as the legal, tax, accounting, and investment consequences, of such decisions.