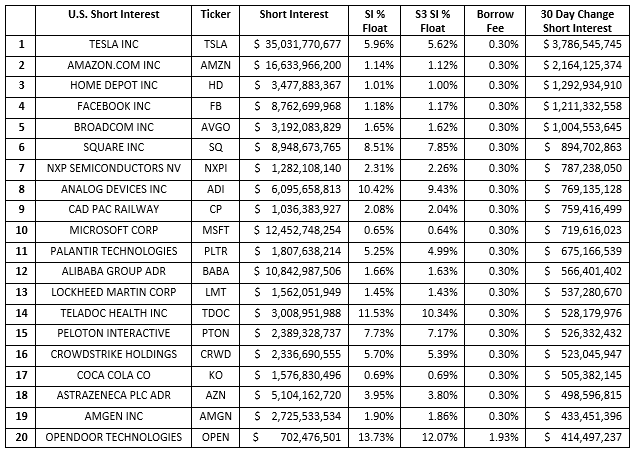

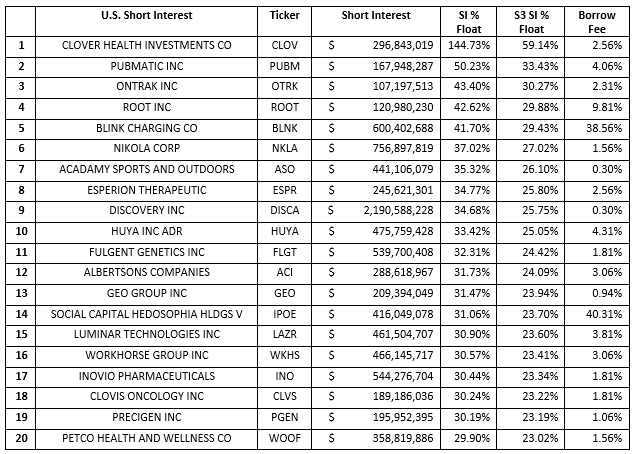

Short interest in the U.S. market decreased by -$35.4 billion, or -3.2%, to $1.08 trillion over the last 30 days. The traditional Short Interest % of Float for the sector is 5.35%, while the S3 Short Interest % of Float (which includes the synthetic shares created by every short sale in the Float number) is 4.81%. The average U.S. traded stock borrow fee is 0.52% fee. The equities\ADRs with the largest short interest are:

The U.S. short interest league table was stable at the top with no change in the ranking of the five most shorted securities, but there was some positional jockeying below.

The most dramatic move was in ViacomCBS Inc B (VIAC) which fell from the number 6 spot to number 38 as its short interest decreased from $9.74 billion to $2.86 billion. Other large decreases in short interest were in Walt Disney Co (DIS) from #17 to #26; Baidu Inc ADR (BIDU) from #22 to #50 and Exxon Mobil Corp (XOM) from #25 to #51.

On the upside, Analog Devices Inc (ADI) moved into the #10 spot from #15; AstraZeneca (AZN) jumped from #20 to #15; Sea Ltd ADR (SE) from #21 to #17 and S&P Global Inc (SPGI) climbed into the top 25, landing at #21 from #31.

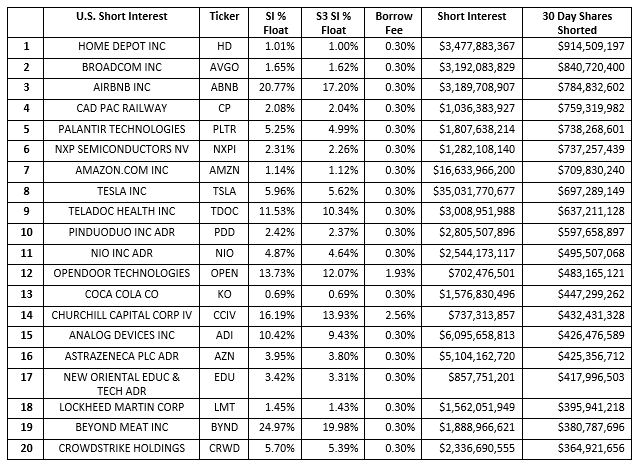

Tech stocks, “stay-at-home” stocks and health stocks make up a large portion of the securities with the largest increase in short interest. The equities\ADRs with the largest increase in short interest over the last 30 days are:

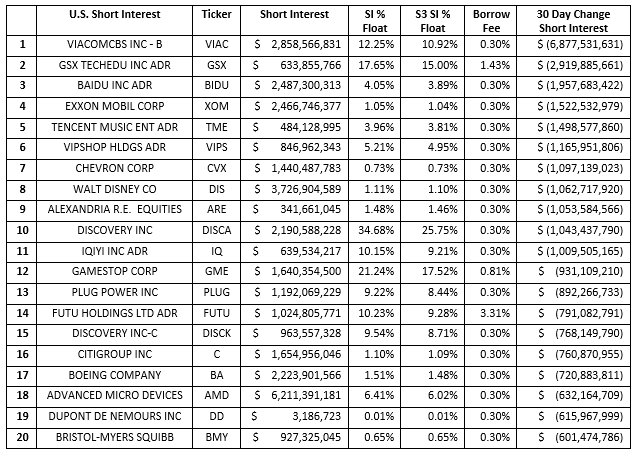

Reddit and Meme stocks dominate the top twenty stocks with the largest decrease in short interest with VIAC, GSX, DISCA, IQ, GME, FUTU and DISCK making the list. Interestingly, most of the decline in short interest in these stocks was the result of mark-to-market stock price moves and not short covering which means that even though their short internet is down it is not due to shorts exiting their positions. The equities\ADRs with the largest decrease in short interest over the last 30 days are:

There are two factors in the -$35.4 billion decrease in overall short interest in U.S. traded equities\ADRs: mark-to-market change in the value of the shares shorted and short side selling\covering. While both mark-to-market changes and short trading activity effect the risk profile of a portfolio short side trading activity can affect a stock’s market price. Large of amounts of short selling can push a stock price down while a large amount of short covering can help raise a stock price.

Stocks with the largest amount of short selling which would have had a negative effect on stock price over the last thirty days are:

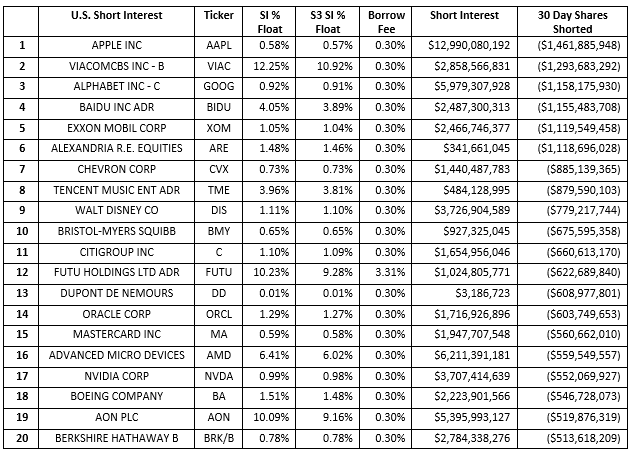

Stocks with the largest amount of short covering which would have had a positive effect on stock price over the last thirty days are:

One of the factors that investors look at to characterize a security as crowded on the short side is Short Interest % of Float. While the traditional SI % Float calculation is flawed because it only uses the capital markets Float number in its denominator (which can produce numbers that are over 100%) the S3 SI % Float adds the synthetic longs created by every short sale to the capital markets Float number to more accurately express tradable shares.

Stocks with over $100 million of short interest with the highest traditional and S3 SI % Float are:

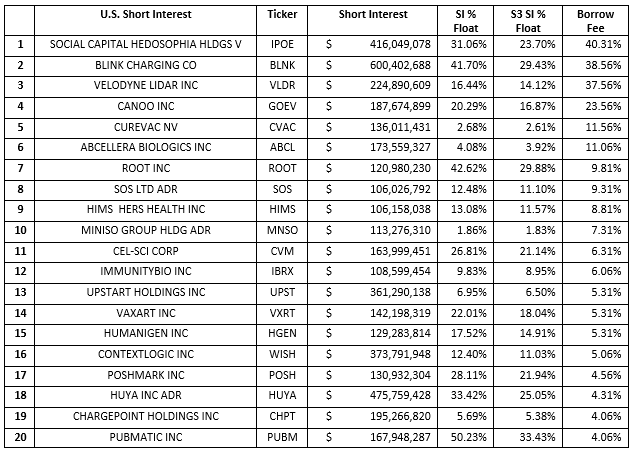

Stock borrow financing fees are drag on profits and are a good indication of the level of conviction that short sellers have in a particular security. Stocks that continue to have significant short interest while incurring large financing fees must have high expected Alpha’s in order to offset their large financing expenses.

Stocks with over $100 million of short interest with the highest stock borrowing fees are:

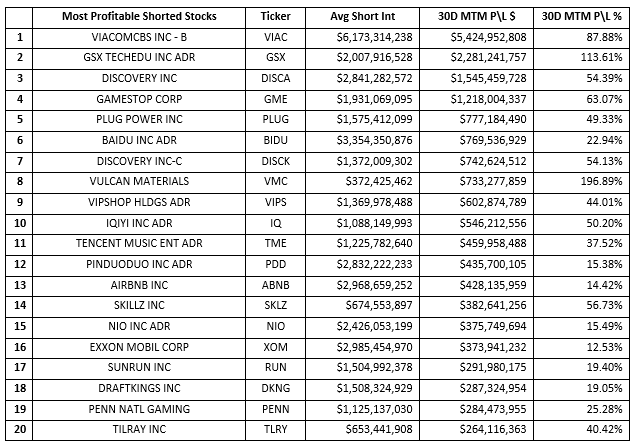

Overall, short sellers have been profitable over the last thirty days earning +$9.79 billion of net-of-financing mark-to-mark profits, a return of +0.90% in thirty days. This was still a stock picker’s market on the short side with 7,484 profitable shorted stocks up +$53.8 billion and 5,795 unprofitable stocks down -$44.0 billion.

Most of the top gainers were the Reddit\Meme stocks that had incurred large mark-to-market losses earlier in the year. With short sellers recouping a portion of their earlier losses the chances of near-term short squeezes in these names have been reduced dramatically. Imminent short squeezes in previously high short squeeze candidate stocks like VIAC, GSX, DISCA and GME are unlikely unless the stocks rally once again and once again turn into unprofitable short trades.

The most profitable equities\ADRs on the short side over the last 30 days were:

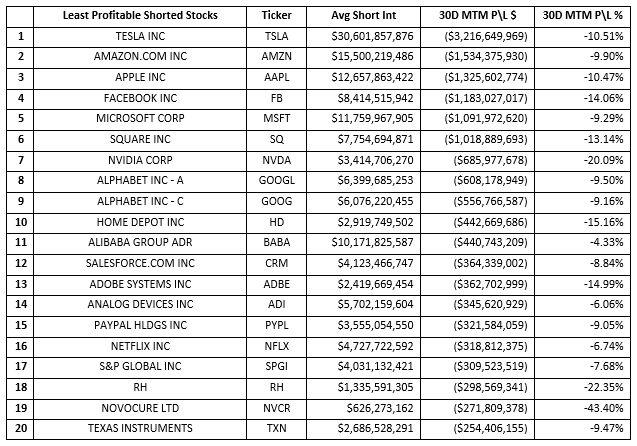

The market has become much more of a momentum play recently, and the following stocks may see a surge in short covering or long buying if their stock prices continue to appreciate. Many of the stocks in the top twenty are tech stocks which suffered a rotational exit by long shareholders earlier in the year only to see a rotational return recently.

The least profitable equities\ADRs on the short side over the last 30 days were:

Looking at short selling trends over time provides insight into overall market sentiment as well as the strength of bearish conviction in individual equities. Our Blacklight SaaS platform and Black APP provides an up to date view of short selling and short covering on an equity, sector, index, or country-wide basis allowing investors\traders to better manage their existing long and short positions.

Research Note written by Ihor Dusaniwsky, Managing Director of Predictive Analytics, S3 Partners, LLC

For deeper insight into short side data and analysis contact me at Ihor.Dusaniwsky@S3Partners.com

Click for 10 Day Complimentary Access to Bloomberg/S3 Black App Pro

The information herein (some of which has been obtained from third party sources without verification) is believed by S3 Partners, LLC (“S3 Partners”) to be reliable and accurate. Neither S3 Partners nor any of its affiliates makes any representation as to the accuracy or completeness of the information herein or accepts liability arising from its use. Prior to making any decisions based on the information herein, you should determine, without reliance upon S3 Partners, the economic risks, and merits, as well as the legal, tax, accounting, and investment consequences, of such decisions.