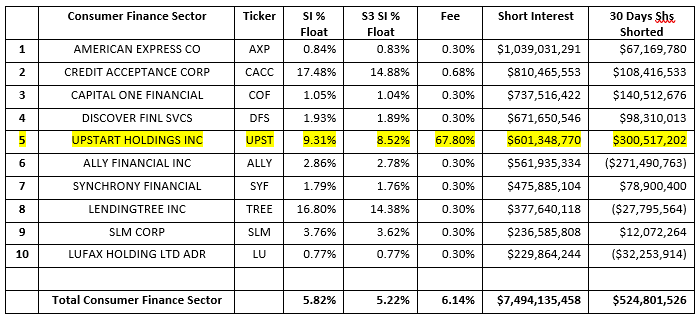

Artificial intelligence lending platform Upstart Holdings Inc (UPST) delivered another strong quarter, beating expectations and raising future guidance. The stock responded by climbing 72% off last week’s May recent low of $84.05/share. And short sellers responded by selling an additional 447 thousand shares into the rally. UPST short interest is currently $601 million, 4.52 million shares shorted, 9.31% short interest % of float, 8.52% S3 SI % Float (which includes the synthetic longs created by every short sale in the trade float denominator) and a 67.80% stock borrow fee which is continuing to climb to rates over 100% fee. UPST is now the fifth most shorted stock in the Consumer Finance Sector.

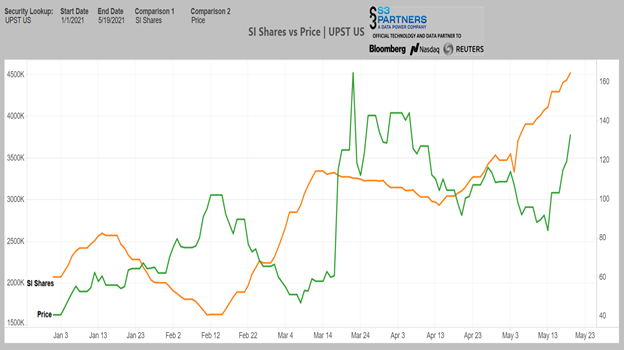

While long shareholders have been driving UPST’s stock price up since its issuance in mid-December 2020, short sellers have been active, on and off, since then as well. UPST’s strong price move starting in the latter half of March squeezed out a handful of short sellers with 354 thousand shares of short covering, -10.6%, as its stock price rose +90.3% over a month long period.

Since then, shorts have been steadily rebuilding their positions with +1.6 million of new shares shorted since April 15th, even as UPST’s stock price rose +27%. Shorts have been looking for a pullback in what they believe is an overheated and over-bought stock that is now up +247% for the year.

Shorts are showing strong conviction in their UPST thesis as they are down -$367 million in year-to-date net-of-financing mark-to-market losses, -141%, but they are not only holding onto their short exposure they are increasing it. Today’s +6.40% mid-day price move has added -$38.5 million to their year-to-date losses.

In addition to suffering large mark-to-market losses short sellers are also suffering large daily financing costs to keep their short exposure active. Stock borrow fees are now topping 67% on existing stock borrows with new stock borrows topping 100% fee. There is very little stock borrow left on the street, with utilization around the 98% level and only a few hundred thousand shares left to borrow. Shorts are now paying over $1.1 million of stock borrow fees per day which is taking a significant bite out of their expected Alpha. If short interest remains at these levels, and short selling demand continues we can expect stock borrow rates to continue to climb.

UPST’s mark-to-market losses and lack of stock borrow liquidity has pushed it to the top level of our Squeeze Score metric with a 10.00 out of 10.00 score. We see UPST having a very high potential of a short squeeze which could push its stock price even higher. But much like a weatherman’s tornado warnings, we can identify stocks with high squeeze potential, but a change in wind speed\direction or stock price is the determinant factor of when and if the squeeze actually occurs. Our Squeeze Score sounds the horn, now investors on both the long and short side can act accordingly.

Looking at short selling trends over time provides insight into overall market sentiment as well as the strength of bearish conviction in individual equities. Our Blacklight SaaS platform and Black APP provides an up to date view of short selling and short covering on an equity, sector, index, or country-wide basis allowing investors\traders to better manage their existing long and short positions.

Research Note written by Ihor Dusaniwsky, Managing Director of Predictive Analytics, S3 Partners, LLC

For deeper insight into short side data and analysis contact me at Ihor.Dusaniwsky@S3Partners.com

Click for 10 Day Complimentary Access to Bloomberg/S3 Black App Pro

The information herein (some of which has been obtained from third party sources without verification) is believed by S3 Partners, LLC (“S3 Partners”) to be reliable and accurate. Neither S3 Partners nor any of its affiliates makes any representation as to the accuracy or completeness of the information herein or accepts liability arising from its use. Prior to making any decisions based on the information herein, you should determine, without reliance upon S3 Partners, the economic risks, and merits, as well as the legal, tax, accounting, and investment consequences, of such decisions.