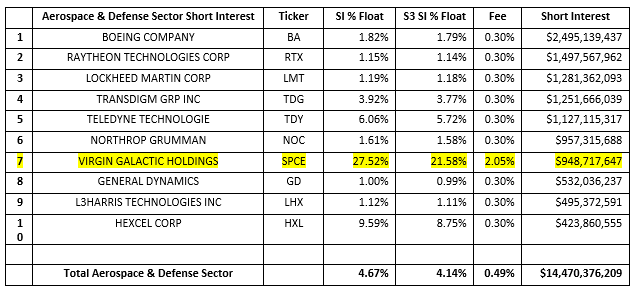

Commercial spaceline and aerospace company Virgin Galactic Holdings (SPCE) successfully completed its third flight into space on Saturday and its stock price reflected the achievement and is up +15% in mid-day trading. SPCE has been an active short in 2021 after flights in December 2020 and February 2021 had setbacks. SPCE short interest is $949 million, 45.03 million shares shorted, 27.52% short interest % of float, 21.58% S3 SI % Float (which includes the synthetic longs created by every short sale in the trade float denominator), and a 2.05% stock borrow fee on existing shorts and rising on new stock borrows. SPCE is the seventh largest short in the Aerospace & Defense Sector.

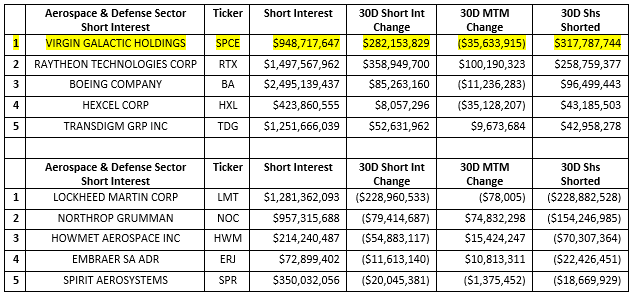

Change in short interest is made up of the change in market value of the underlying stocks as well as short selling and short covering activity in these stocks. While SPCE had the second largest increase in short interest over the last 30 days, behind Raytheon Technologies Corp (RTX) it had the most new short selling in the sector over the last 30 days. We saw $318 million worth on new SPCE short selling over the last 30 days and $259 million worth of new short selling in RTX. On the other side of the ledger, we there was $229 million worth of new short covering in Lockheed Martin (LMT) and $154 million of short covering in Northrop Grumman (NOC). Overall, there was $371 million of new short selling in the Aerospace & Defense Sector as short sellers increased their exposure in a slightly downward trending sector.

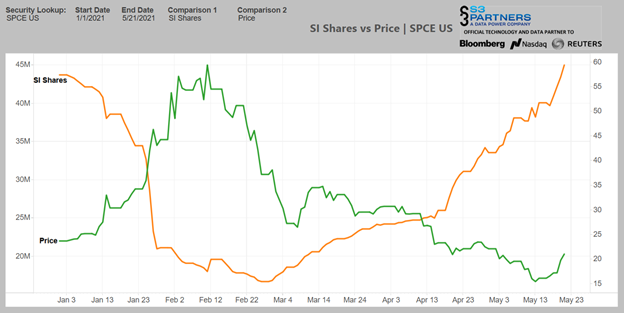

SPCE short sellers have been active since the beginning of March after buying back more than half their exposure in the first two and a half months of the year as its stock price soared +150%. SPCE stock price gave back 74% of its value since it hit its year-to-date high on February 11th and short sellers shorted 25.4 million shares, worth $536 million, as its stock price tumbled. Recently we have seen a bounce off its lows and today’s price move pushed SPCE’s stock price +56% off its recent low.

SPCE short sellers are down -$427 million in year-to-date mark-to-market losses with -$366 million of those losses incurred over the last eight days, including -$134 million on today’s +15% price move. These recent losses have made SPCE one of the stocks most susceptible to a short squeeze. SPCW is one of the more crowded stocks in the market it is not massively crowded due to its moderate liquidity in the stock loan and trading markets , scoring a 7.50 out of 10.00 in our Crowded Score metric. SPCE does however score highly in our Squeeze Score metric. SPCE’s recent mark-to-market losses have added to its moderately high Crowded Score and pushed its Squeeze Score to a 10.00 out of 10.00. If its stock price keeping rising, there is a good chance short sellers will be cutting exposure.

Over the past 30 days we have seen +13.9 million new SPCE shares shorted, worth $293 million, and +4.9 million new shares shorted, worth another $104 million, over the last 7 days. With SPCE’s stock price rallying, we should at minimum expect this surge in short selling come to an abrupt stop and more likely be replaced with short covering. With shorts down -56% in mark-to-market losses since its recent low, it is likely that some of the newer shorts with less conviction may start trimming their positions and if these buy-to-covers provide a booster to SPCE’s stock price, a full-on short squeeze is not out of the question.

Looking at short selling trends over time provides insight into overall market sentiment as well as the strength of bearish conviction in individual equities. Our Blacklight SaaS platform and Black APP provides an up to date view of short selling and short covering on an equity, sector, index, or country-wide basis allowing investors\traders to better manage their existing long and short positions.

Research Note written by Ihor Dusaniwsky, Managing Director of Predictive Analytics, S3 Partners, LLC

For deeper insight into short side data and analysis contact me at Ihor.Dusaniwsky@S3Partners.com

Click for 10 Day Complimentary Access to Bloomberg/S3 Black App Pro

The information herein (some of which has been obtained from third party sources without verification) is believed by S3 Partners, LLC (“S3 Partners”) to be reliable and accurate. Neither S3 Partners nor any of its affiliates makes any representation as to the accuracy or completeness of the information herein or accepts liability arising from its use. Prior to making any decisions based on the information herein, you should determine, without reliance upon S3 Partners, the economic risks, and merits, as well as the legal, tax, accounting, and investment consequences, of such decisions.