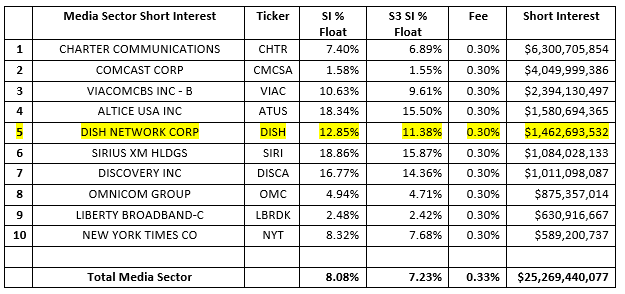

Dish Network Corp (DISH US) short interest is $1.46 billion, 31.92 million shares shorted, 12.85% Short Interest % Float, 11.38% S3 SI % Float (which includes the synthetic longs created by every short sale in the trade float denominator) and 0.30% (General Collateral) stock borrow fee. DISH is the fifth largest short in the Media Sector.

DISH short exposure has been increasing recently, with short interest growing by $325 million, +29%, over the last 30 days. Only Charter Communications (CHTR US) had a larger increase in short interest, +$1.02 billion, as its stock price rose +11.3% and short sellers added $430 million of new short sales during the last 30 days.

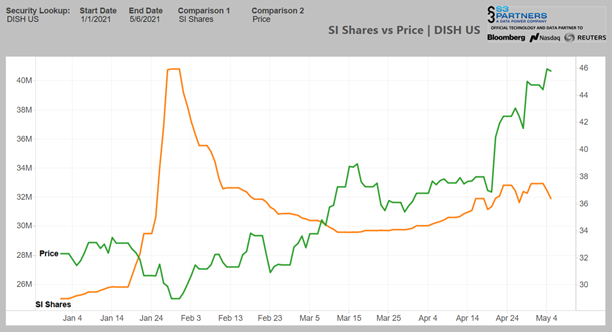

DISH’s stock price move outpaced CHTR’s rise with a +21.6% increase over the last thirty days and short sellers were also active in the stock with 1.75 million new shares shorted, worth $80 million, over those thirty days. Shorts were looking for a price pullback after its recent strong and sudden runup.

Over the last week we have seen DISH short sellers not only take a breather but begin to decrease their short exposure by covering 481 thousand shares, worth $22 million as DISH’s stock price continued its upward price move with a +10% recent return.

DISH has been a relatively crowded stock, scoring between a 5.75 – 6.25 out of 10 in or Crowded Score metric, but it has recently moved in high Squeeze potential territory in our Squeeze Score metric. For most of April, DISH’s Squeeze Score was moderately high, in the 6 range, signaling us that there the stock was beginning to be more and more susceptible to a Short Squeeze. But after breaking the $40/share level on April 21st , the first time over $40/share since February 2020, its Squeeze Score topped 8.00 for the first time this year and has ranged between 8.25-9.25 out of 10.00 since then.

DISH’s S3 % Float has been steadily climbing along with its mark-to-market losses, a sure sign that a stock is getting closer to a short squeeze if stock prices continue to trend upwards.

DISH short sellers are down -$452 million in year-to-date net-of-financing mark-to-market losses, -42%. But more importantly, over a quarter of those losses occurred over the last week as shorts were down -$135 million in mark-to-market losses, -11%. Recent large mark-to-market losses coupled with more short side crowding are strong catalysts for a short squeeze.

As we have seen over the last week, shorts have begun to cover their positions. If DISH’s stock price continues its upwards trajectory shorts will incur more mark-to-market losses and those with less conviction will start covering some of their exposure. A sizable number of buy-to-covers could bid up DISH’s stock price even more than just the present long side buying pressure and force even more shorts out – creating a legitimate short squeeze. We will have to wait and see if DISH shares shorted dip below the 30 million share level we last saw in late March and begin to trend downward toward the pre-pandemic 25 million shares level. Such a large amount of short covering would constitute a Short Squeeze and push DISH’s stock price even higher.

Looking at short selling trends over time provides insight into overall market sentiment as well as the strength of bearish conviction in individual equities. Our Blacklight SaaS platform and Black APP provides an up to date view of short selling and short covering on an equity, sector, index, or country-wide basis allowing investors\traders to better manage their existing long and short positions.

Research Note written by Ihor Dusaniwsky, Managing Director of Predictive Analytics, S3 Partners, LLC

For deeper insight into short side data and analysis contact me at Ihor.Dusaniwsky@S3Partners.com

Click for 10 Day Complimentary Access to Bloomberg/S3 Black App Pro

The information herein (some of which has been obtained from third party sources without verification) is believed by S3 Partners, LLC (“S3 Partners”) to be reliable and accurate. Neither S3 Partners nor any of its affiliates makes any representation as to the accuracy or completeness of the information herein or accepts liability arising from its use. Prior to making any decisions based on the information herein, you should determine, without reliance upon S3 Partners, the economic risks, and merits, as well as the legal, tax, accounting, and investment consequences, of such decisions.