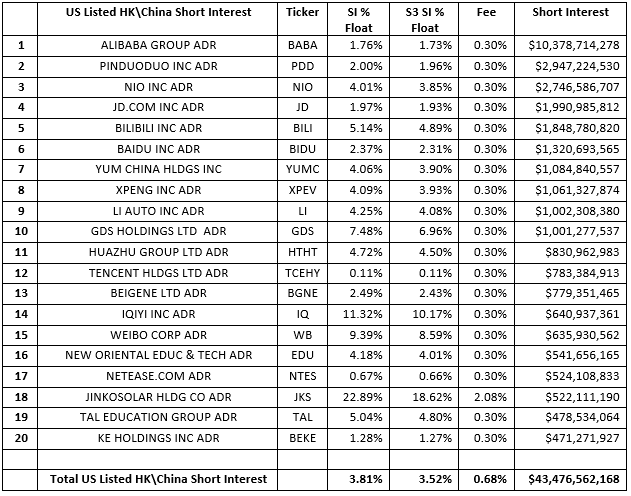

Just days after ride hailing Didi Global Inc’s (DIDI) $4.4 billion U.S. listed IPO China’s State Council that it will implementing more extensive supervision and regulation for cyberspace related securities and ordered DIDI’s app removed from app stores. DIDI is down -21% on the news in mid-afternoon trading and most of the U.S. listed H.K. – China securities are down on the news. The KraneShares CSI China Internet Fund ETF (KWEB) is down -4.9% in mid-afternoon trading. Short interest in these H.K. – China securities have been decreasing in 2012, dropping -14% as short interest went from $50.6 billion to $43.5 billion and Short Interest % of Float fell from 5.67% to 3.81%.

Over the last 30 days we have seen $398 million of short covering in U.S. listed H.K. – China securities and with possible apprehension and uncertainty in investing in these securities we may see a reversal of short covering and acceleration of short selling in last month’s active short activity.

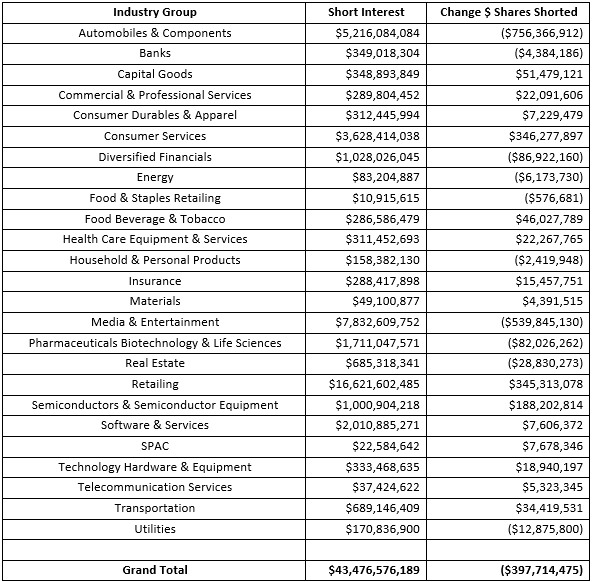

A dive into the changes of the most covered and most shorted Industry Groups over the last month reveals the following short side trading activity over +\- $20 million:

- Automobiles & Components -$756 million

- NIO Inc (NIO) -$672 million

- Xpeng Inc ADR (XPEV) -$74 million

- Li Auto Inc ADR (LI) -$29 million

- Consumer Services +$346 million

- TAL Education Group (TAL) +$160 million

- Gaotu Techedu Inc (GOTU) +$110 million

- New Oriental Education & Technology Group Inc (EDU) +$94 million

- Huazhu Group Ltd ADR -$27 million

- Media & Entertainment -$540 million

- Bilibili Inc (BILI) -$396 million

- NetEase Inc (NTES) -$134 million

- Baidu Inc (BIDU) +$115 million

- Weibo Corp ADR (WB) -$41 million

- Retailing +$345 million

- Alibaba Group Holding Ltd (BABA) +$530 million

- com Inc (JD) -$119 million

- com Group Ltd ADR (TCOM) -$107 million

- Pinduoduo Inc (PDD) +$86 million

- Vipshop Holdings Ltd (VIPS) -$61 million

- Semiconductors & Semiconductor Equipment +$188 million

- JinkoSolar Holding Co Ltd (JKS) +$143 million

- Daqo New Energy Corp (DQ) +$20 million

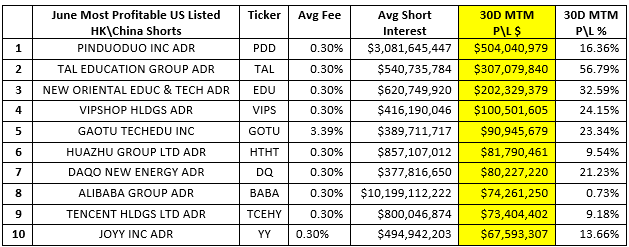

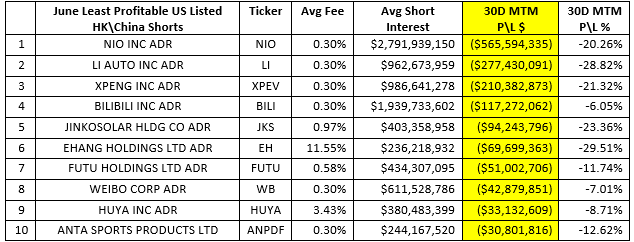

U.S. listed H.K. – China securities have been, on aggregate, a profitable short in 2021 although it was only in June when January\February mark-to-market losses were erased. Shorts were up +$645 million in June mark-to-market profits, a return of +1.47% on an average short interest of $44.0 billion.

Short sellers in the twenty most shorted U.S. listed H.K. – China securities, $31.6 billion of short interest, were up $840.5 million in mark-to-market profits, +2.66% today. We should expect more short selling and a reduction of short covering in U.S. listed H.K. – China securities as today’s price action may be foretelling greater expected Alpha in the near term.

Looking at short selling trends over time provides insight into overall market sentiment as well as the strength of bearish conviction in individual equities. Our Blacklight SaaS platform and Black APP provides an up to date view of short selling and short covering on an equity, sector, index, or country-wide basis allowing investors\traders to better manage their existing long and short positions.

Research Note written by Ihor Dusaniwsky, Managing Director of Predictive Analytics, S3 Partners, LLC

For deeper insight into short side data and analysis contact me at Ihor.Dusaniwsky@S3Partners.com

For short side data and access to our research reports go to https://shortsight.com/

Click for 10 Day Complimentary Access to Bloomberg/S3 Black App Pro

The information herein (some of which has been obtained from third party sources without verification) is believed by S3 Partners, LLC (“S3 Partners”) to be reliable and accurate. Neither S3 Partners nor any of its affiliates makes any representation as to the accuracy or completeness of the information herein or accepts liability arising from its use. Prior to making any decisions based on the information herein, you should determine, without reliance upon S3 Partners, the economic risks, and merits, as well as the legal, tax, accounting, and investment consequences, of such decisions.