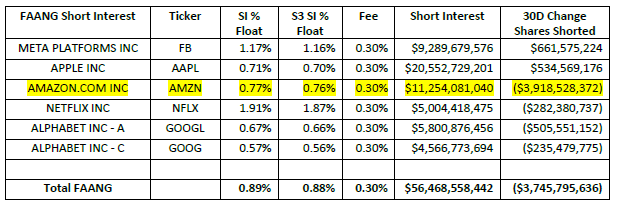

FAANG stocks were up an average of +27.3% in 2021 but Amazon.com Inc (AMZN) underperformed the group significantly with only a +2.4% return. Shorting FAANG stocks was an unprofitable strategy in 2021, contributing $14.6 billion of mark-to-market losses to short seller’s bottom lines. Surprisingly, only AMZN is seeing outsized recent short covering in the group, with almost $4 billion of buy-to-covers over the last thirty days, a -26.5% decrease in shares shorted. Much like Punxsutawney Phil not seeing his shadow and predicting an early spring, AMZN short covering may be a harbinger of a much greener price performance in 2022.

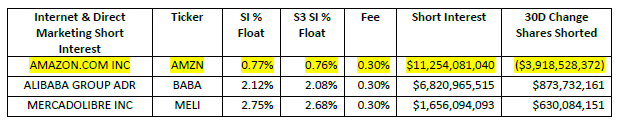

We see the same short covering – short selling divergence when comparing AMZN’s shorting activity to its large Internet & Direct Marketing Retail cohorts. Instead of short covering, we are seeing additional short selling in Alibaba Group ADR (BABA) and MercadoLibre Inc (MELI) over the last thirty days which tells us AMZN’s short covering is not a sector trend but specific to AMZN.

While the almost $4 billion of AMZN short covering did not push its stock price higher, shares are down -5% over the last thirty days, the reduction of AMZN short exposure does signify a decrease of short side conviction for many short sellers. With the short side thinking less negatively about AMZN’s stock price performance, it is not irrational to think that the long side will become more positive concerning AMZN’s stock price performance as well. If shorts continue covering and the long side increases buying pressure, we may see a rally in AMZN’s stock price in early 2022.

Looking at short selling trends over time provides insight into overall market sentiment as well as the strength of bearish conviction in individual equities. Our Blacklight SaaS platform and Black APP provides an up-to-date view of short selling and short covering on an equity, sector, index, or country-wide basis allowing investors\traders to better manage their existing long and short positions.

Research Note written by Ihor Dusaniwsky, Managing Director of Predictive Analytics, S3 Partners, LLC

For deeper insight into short side data and analysis contact me at Ihor.Dusaniwsky@S3Partners.com

For short side data and access to our research reports go to https://research.s3partners.com .

Click for 10 Day Complimentary Access to Bloomberg/S3 Black App Pro

The information herein (some of which has been obtained from third party sources without verification) is believed by S3 Partners, LLC (“S3 Partners”) to be reliable and accurate. Neither S3 Partners nor any of its affiliates makes any representation as to the accuracy or completeness of the information herein or accepts liability arising from its use. Prior to making any decisions based on the information herein, you should determine, without reliance upon S3 Partners, the economic risks, and merits, as well as the legal, tax, accounting, and investment consequences, of such decisions.