Uranium stocks and ETFs have had a very strong 2021 with the Sprott Physical Uranium Trust (U-U CN, SRUUF US) up 49% for the year. Two ETFs that hold uranium mining, exploration and production stocks are the Global X Uranium ETF (URA US) and NorthShore Global Uranium Mining ETF (URNM US) were up +51% and +76% respectively.

Internet social media, mostly Reddit’s WallStreetBets subgroup, has been touting uranium’s 2021 price move and the relative illiquidity of these stocks as potential highflyers. Although stock prices have been rallying on much higher trading volumes that were seen prior to September the possibility of relevant short squeezes in most of these stocks are minimal as there are only three uranium mining stocks with over $100 million of short interest.

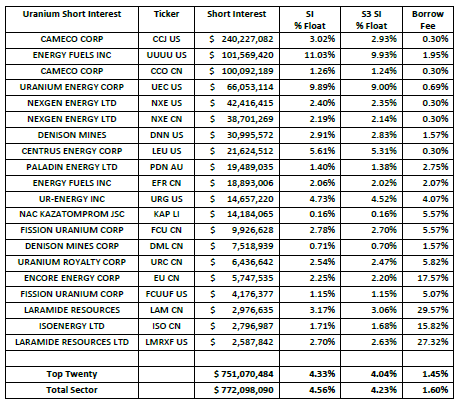

There are 64 U.S. and internationally traded uranium stocks in our basket, with many of the stocks dually listed and trading on multiple exchanges. Total short interest of this basket of uranium stocks is $772 million, with the vast majority of the short selling concentrated in the top dozen names.

The U-U CN trust hit its year-to-date high on September 13th while the URA US and URNM US ETFs hit their year-to-date highs on September 15th, and since hitting those highs they are down -20%, -19% and -23% respectively. With uranium stocks giving back a chunk of its year-to-date rally we may see more short selling in these stocks.

If the recent downward trend in these uranium stocks reverses and stock prices head back toward recent highs the “meme momentum” play may be reinvigorated, and this recent short rally may turn into a short squeeze for the more shorted names. Reddit long buyers are not only looking to buy upward trending uranium stocks – they are also looking for uranium stocks with larger short interest to squeeze.

Short sellers in Cameco Corp (CCO CN, CCJ US), Energy Fuels Inc (EFR CN, UUUU US), Uranium Energy Corp (UES US), NextGen Energy Ltd (NXE CN, NXE US) and Denison Mines (DML CN, DNN US) need to be alert and be ready to cover their positions if they want to lock in recent mark-to-market gains.

Looking at short selling trends over time provides insight into overall market sentiment as well as the strength of bearish conviction in individual equities. Our Blacklight SaaS platform and Black APP provides an up-to-date view of short selling and short covering on an equity, sector, index, or country-wide basis allowing investors\traders to better manage their existing long and short positions.

Research Note written by Ihor Dusaniwsky, Managing Director of Predictive Analytics, S3 Partners, LLC.

For deeper insight into short side data and analysis contact me at Ihor.Dusaniwsky@S3Partners.com.

For short side data and access to our research reports go to https://https://research.s3partners.com/.

The information herein (some of which has been obtained from third party sources without verification) is believed by S3 Partners, LLC (“S3 Partners”) to be reliable and accurate. Neither S3 Partners nor any of its affiliates makes any representation as to the accuracy or completeness of the information herein or accepts liability arising from its use. Prior to making any decisions based on the information herein, you should determine, without reliance upon S3 Partners, the economic risks, and merits, as well as the legal, tax, accounting, and investment consequences, of such decisions.