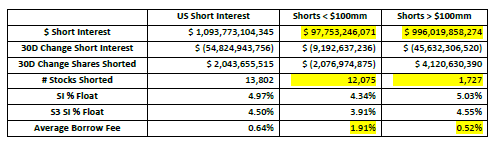

We follow 13,802 U.S. traded stocks and ADRs with active shares shorted in our Blacklight SaaS platform and Black App with $1.09 trillion of short interest. Average Short Interest % of Float is 4.97% and S3 SI % Float (which includes synthetic longs created by every short sale in the Float number) is 4.50%, while the average stock borrow fee is 0.64%.

When we differentiate shorted stocks by the size of total short interest in a security (a measure of how broad and concentrated short selling activity in a security is) and stock borrow financing costs (a measure of how whether the availability of stock borrowing and future short selling is getting more difficult or more expensive to execute) we see discernable differences in activity and profitability.

We can break down shorted stocks by the amount of $ short interest by creating two buckets, securities with over $100 million of short interest versus securities with less than $100 million of short interest to denote shorted stocks with a wide breadth of short selling activity versus more thinly shorted stocks. While total short interest in the most shorted securities is ten times larger than the less shorted securities ($996 billion vs $98 billion) there are seven times more individual securities with lighter short interest versus heavier shorted stocks (12.1 thousand versus 1.1 thousand names).

SI % Float is, as expected lower in the more lightly short stocks but stock borrow rates are almost four times more expensive in those stocks. While less of a stock’s float is being shorted in these more lightly shorted securities, there is also less of the stock’s float in the lending supply which leads to stock lenders charging more for scarcer stock loan availability.

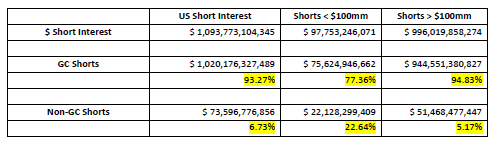

When looking at the breakout of stock borrow cost, we see that while 93% of all shorted stocks are getting charged General Collateral stock borrow rates (G.C. rates, which are the cheapest rates for the easiest to borrow stocks) only 77% of the more lightly shorted securities are being charges G.C. rates versus 95% for the heavier shorted stocks.

Stocks with the largest short interest are usually large or mega cap names, which usually have large amounts of lendable shares and that excess inventory translates into lower borrow rates. Stock with lighter short interest are usually smaller cap names, which will have, by definition, smaller lending pools and may not be in the major indexes that are held by most of the large lending platforms and therefore trade at rates over G.C.

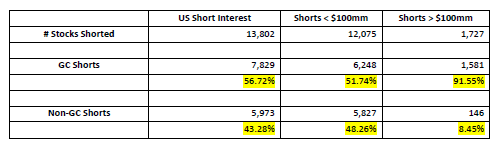

While the dollar amount of short selling is heavily skewed to General Collateral stocks, the actual number of G.C. versus non-G.C. securities is much more equally divided with 57% of all shorted stocks at G.C. levels and 43% of all stocks at over G.C. levels.

When looking at the breakdown between the more lightly and heavily shorted stocks we see a strong divergence. The more lightly shorted stocks are split relatively evenly between G.C. and non-G.C. (52% vs 48%), but the more heavily short stocks are predominantly G.C. names (92% vs 8%). The main reason for this difference is that for a stock to be heavily shorted there needs to be a large lendable inventory to satisfy the larger stock borrow and short selling demand, and as we learned in Econ 101, larger overall supply usually leads to cheaper prices.

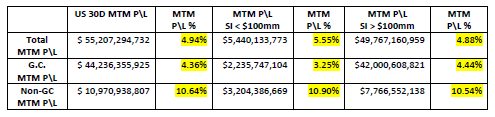

With financing costs being more expensive for non-G.C. stocks the expected Alpha for these stocks must be higher to offset the larger financing expenses incurred in these names. Over the last thirty days the average return on the short side was +4.94%. With the S&P 500 down -3.79%, Nasdaq down -5.61% and Russell 3000 down -3.89% we see that short sellers outperformed most of the market.

In a recent report “New Insights from Securities Lending Data”, Yin Luo of Wolfe Research stated that higher Alpha continues to exist in non-G.C. (harder to borrow) securities and that is highlighted by the more than 2X returns we saw over the last thirty days in non-G.C. shorted stocks (+10.64% vs +4.36%).

If we look beyond just stock borrow rates as the “canary in a coal mine” to alert traders to securities with cost related limited arbitrage activity and therefore an anomaly in the efficient market thesis we can use the S3 Crowded Score as a more evolved “canary”.

The S3 Crowded Score is a multi-factor model which includes liquidity in the stock loan market (both rates and utilization\availability), total dollar amount of the short position (measuring the breadth of short selling in the market), the S3 short interest as a percentage of float (measuring the amount of short selling compared to the actual tradable float of a stock including the “synthetic” long positions created by every short sale), and daily trading capacity to rank the “crowdedness” of a security.

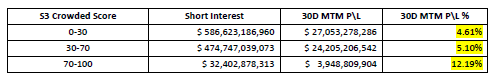

If we look back thirty days and calculate the mark-to-market profit\loss of three ranges of Crowded Scores we can see that shorted stocks that are not crowded or marginally crowded posted a return of around +5%. But the most crowded shorts, securities with a 70-100 Squeeze Score, had more than a +12% return over the last thirty days.

Last month’s data showed us that shorting hard-to-borrow stocks produced higher returns than shorting easy-to-borrow or G.C. stocks. This may be a function of limited short selling allowing stock prices to rise more than they would if short selling was not limited or the fact that these shorts are the most popular\broadly shorted (crowded) stocks and therefore the best short ideas on the street.

The outsized return that these shorts produced indicates that both longs and shorts should pay attention to the crowdedness of shorted securities in booth long-side and short-side portfolio selection and management. Long shareholders minimizing exposure to these names while short sellers increasing their exposure.

Looking at short selling trends over time provides insight into overall market sentiment as well as the strength of bearish conviction in individual equities. Our Blacklight SaaS platform and Black APP provides an up-to-date view of short selling and short covering on an equity, sector, index, or country-wide basis allowing investors\traders to better manage their existing long and short positions.

Research Note written by Ihor Dusaniwsky, Managing Director of Predictive Analytics, S3 Partners, LLC

For deeper insight into short side data and analysis contact me at Ihor.Dusaniwsky@S3Partners.com

For short side data and access to our research reports go to https://research.s3partners.com/

Click for 10 Day Complimentary Access to Bloomberg/S3 Black App Pro

The information herein (some of which has been obtained from third party sources without verification) is believed by S3 Partners, LLC (“S3 Partners”) to be reliable and accurate. Neither S3 Partners nor any of its affiliates makes any representation as to the accuracy or completeness of the information herein or accepts liability arising from its use. Prior to making any decisions based on the information herein, you should determine, without reliance upon S3 Partners, the economic risks, and merits, as well as the legal, tax, accounting, and investment consequences, of such decisions.