After an early year rally in the Homebuilders sector, we had seen stock prices trending downward since the middle of May but now rebounding since the middle of October. With unemployment falling and wages rising, building costs soaring, mortgage rates falling earlier in the year but rising now and housing supply still tight the Homebuilding sector has been a rollercoaster of profits and losses for both the long and short side of the market.

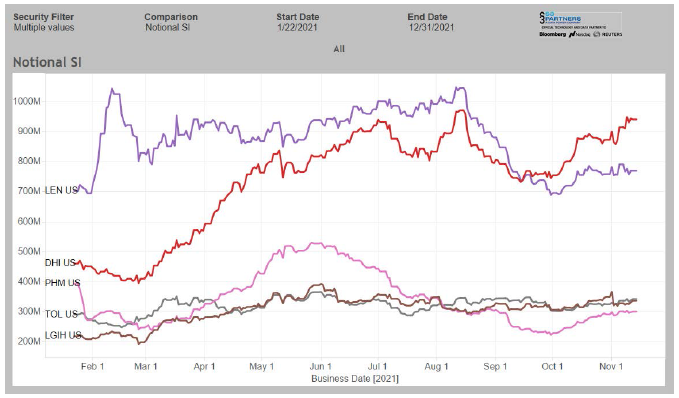

Short interest in the Homebuilders sector has risen substantially since its $1.65 billion low in early April. After topping out for the year at $4.92 billion in June we saw some short covering in the sector and short interest fell to $3.85 billion in early October. Shorts are once again building their short exposure and short interest is back above $4 billion level at $4.56 billion.

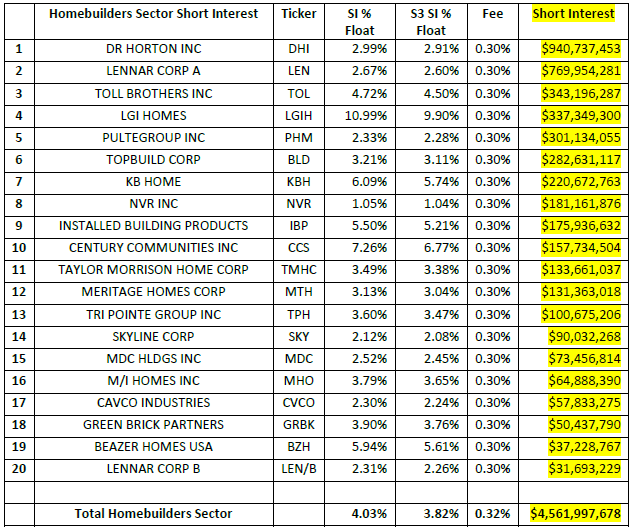

The Homebuilder sector’s average Short Interest % Float is 4.03% while the average S3 SI % Float of 3.82% (which includes the synthetic longs created by every short sale in the trade float denominator) with an average stock borrow fee of 0.32%. In contrast, stocks in the U.S. have a total short interest of SI % Float of 5.14%, S3 SI % Float of 4.65% and an average stock borrow fee of 0.73%. The Homebuilders sector is one of the more lightly shorted sectors in the U.S. market.

DR Horton Inc (DHI) and Lennar Corp A (LEN) continue to be the two largest shorts in the sector:

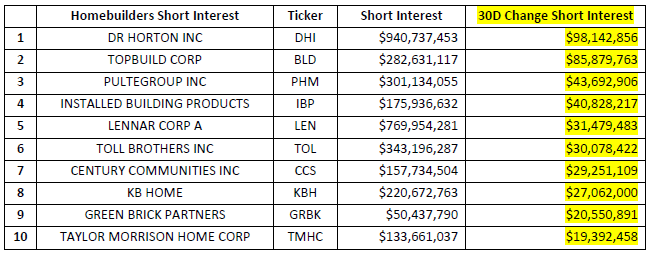

Total short interest in the Homebuilders sector has increased from $4.07 billion to $4.56 billion over the last 30 days. This +$401 million increase consisted of a +$536 million change in market value due to stock price increases offset by -$45 million of short covering. Even as Homebuilder stock prices rose and they suffered mark-to-market losses, short sellers only trimmed a small portion of their exposure and seem to be looking for the price weakness we saw in the summer and early fall to return.

Two-thirds of the stocks in the Homebuilders sector saw their short interest numbers increase over the last thirty days. The short interest of the 41 stocks with increases were up +$516 million while the 23 stocks that had a decrease in short interest only had a total drop of -$25 million. The sector wide trend seems to be to take the recent mark-to-market losses on the chin, hold onto your shorts and look for price weakness in the near future.

The Homebuilder stocks with the largest increase in short interest over the last thirty days are:

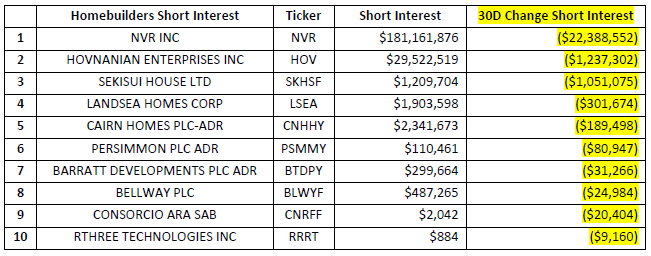

The Homebuilder stocks with the largest decrease in short interest over the last thirty days are:

Shorting the Homebuilder sector in this year has not been profitable trade. Short sellers are down -$1.31 billion in year-to-date mark-to-market losses, down -31.04% for the year. Over a third of those losses were incurred over the last thirty days with short sellers down -$476 million, or -10.88%.

Only $10 million of Homebuilder short interest was profitable over the last thirty days with a meager profit of $113 thousand, a +1.16% return. But there was an average of $4.4 billion of unprofitable short trades over the last thirty days, with a total mark-to-market loss of -$477 million, or a -10.91% return.

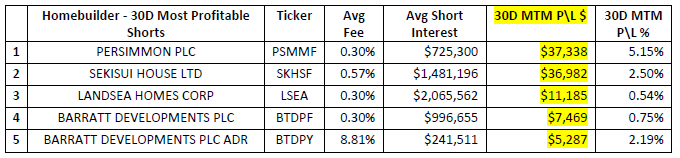

There were no stocks with over +$100k of mark-to-market profits over the last thirty days, the top five most profitable shorts were:

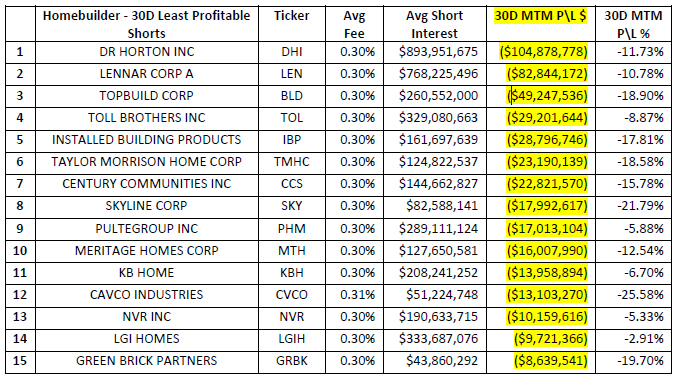

Dr Horton Inc (DHI) short sellers had the largest mark-to-market loss over the last thirty days, down -$104.9 million, a -11.73% return. The top fifteen least profitable short trades in the Homebuilders sector were:

Green Brick Partners (GRBK) and LIGI Homes (LGIH). Short selling into a rising market tells us that short sellers are looking for even more exposure to these stocks even as the value of their short positions were increasing due to price appreciation. On the other hand, we saw minor short covering in Lennar Corp A (LEN), NVR Inc (NVR), Dr Horton Inc (DHI) and Meritage Homes Inc (MTH) as short sellers tried to offset a small portion of the increase in market value of their short positions due to price appreciation.

But whether shorting into the rally or covering some of their positions, most Homebuilder sector short sellers saw their overall exposure increase and continue to be bearish.

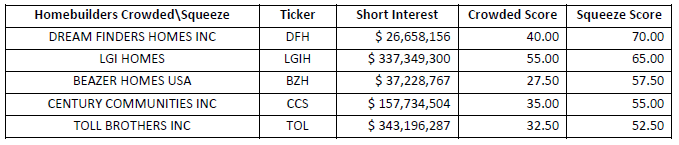

While there are no highly squeezable stocks in the Homebuilders sector at the moment, if mark-to-market losses continue to mount Squeeze Scores will start to rise and there will be some short sellers looking to exit their positions.

There is one Homebuilder stock that is in squeeze territory, Dream Finder Homes Inc (DFH), while there are several inching into legitimate squeeze territory but not quite there yet.

The highest Squeeze scores in the Homebuilders sector are:

Looking at short selling trends over time provides insight into overall market sentiment as well as the strength of bearish conviction in individual equities. Our Blacklight SaaS platform and Black APP provides an up-to-date view of short selling and short covering on an equity, sector, index, or country-wide basis allowing investors\traders to better manage their existing long and short positions.

Research Note written by Ihor Dusaniwsky, Managing Director of Predictive Analytics, S3 Partners, LLC

For deeper insight into short side data and analysis contact me at Ihor.Dusaniwsky@S3Partners.com

For short side data and access to our research reports go to https://research.s3partners.com .

Click for 10 Day Complimentary Access to Bloomberg/S3 Black App Pro

The information herein (some of which has been obtained from third party sources without verification) is believed by S3 Partners, LLC (“S3 Partners”) to be reliable and accurate. Neither S3 Partners nor any of its affiliates makes any representation as to the accuracy or completeness of the information herein or accepts liability arising from its use. Prior to making any decisions based on the information herein, you should determine, without reliance upon S3 Partners, the economic risks, and merits, as well as the legal, tax, accounting, and investment consequences, of such decisions.