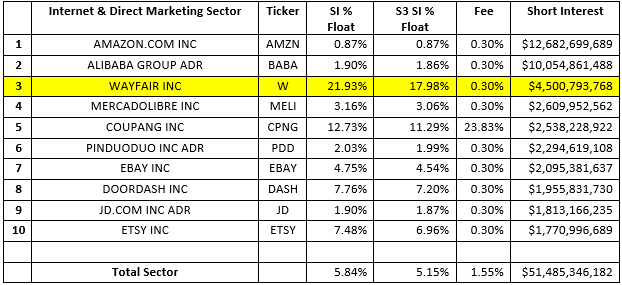

Wayfair Inc (W) 2nd quarter results beat on earnings but fell slightly below expected revenues and the stock has been rallying this week. Wayfair is the 3rd largest short in the Internet & Direct Marketing Sector with $4.5 billion worth of short interest.

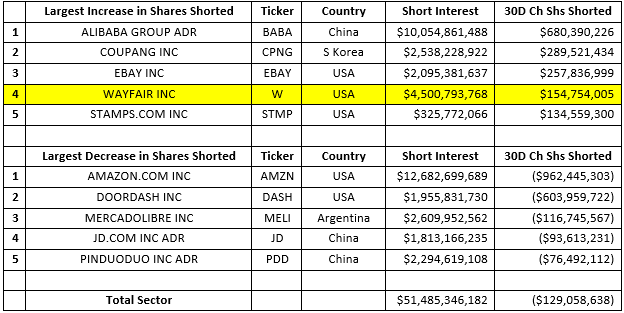

Wayfair short sellers were active with $155 million of new shares shorted over the last month.

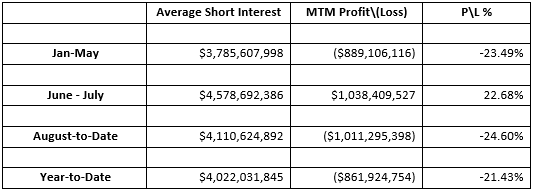

Wayfair shorts have had a roller coaster year with net-of-financing mark-to-market profits in June and July more than offsetting losses incurred from January to May. August’s rally has turned the ledger red again and Wayfair short sellers are now down $862 million in year-to-date mark-to-market losses. This includes down -$318 million on todays over +7% move as of mid-day trading.

The recent surge in Wayfair’s stock price has turned a crowded short, with an 82.50\100 S3 Crowded Score, into a stock with high short squeeze potential, with a 100\100 S3 Squeeze Score. Recent mark-to-market losses may force some short sellers to reduce their exposure in order to realize any profits left from June\July’s stock price drop or minimize their recent losses.

Wayfair shares shorted have been increasing since the end of January, but we may be seeing a change in this long-term trend if shorts get squeezed. If in fact, we do see widespread short covering we should see the recent Wayfair rally to continue as short side buy-to-covers bid-up shares alongside long-buyers.

Looking at short selling trends over time provides insight into overall market sentiment as well as the strength of bearish conviction in individual equities. Our Blacklight SaaS platform and Black APP provides an up-to-date view of short selling and short covering on an equity, sector, index, or country-wide basis allowing investors\traders to better manage their existing long and short positions.

Research Note written by Ihor Dusaniwsky, Managing Director of Predictive Analytics, S3 Partners, LLC

For deeper insight into short side data and analysis contact me at Ihor.Dusaniwsky@S3Partners.com

For short side data and access to our research reports go to https://shortsight.com/

Click for 10 Day Complimentary Access to Bloomberg/S3 Black App Pro

The information herein (some of which has been obtained from third party sources without verification) is believed by S3 Partners, LLC (“S3 Partners”) to be reliable and accurate. Neither S3 Partners nor any of its affiliates makes any representation as to the accuracy or completeness of the information herein or accepts liability arising from its use. Prior to making any decisions based on the information herein, you should determine, without reliance upon S3 Partners, the economic risks, and merits, as well as the legal, tax, accounting, and investment consequences, of such decisions.